Why is it no longer meaningful to apply the cycle theory to memory stocks?

A new paradigm requires a new multiple.

Today in Korea, SK Securities made headlines by setting a target price of 1 million won for SK Hynix.

Since this aligns with what I’ve been asserting for some time, I plan to process and share that report with all of you.

Before we begin, let me briefly note that SK Securities is no longer owned by the SK Group.

Therefore, I believe—and trust—that SK Securities’ decision to assign the highest target price for SK Hynix among both domestic and international brokerages was made without any external pressure.

Why was memory valuation based on PBR: high earnings volatility

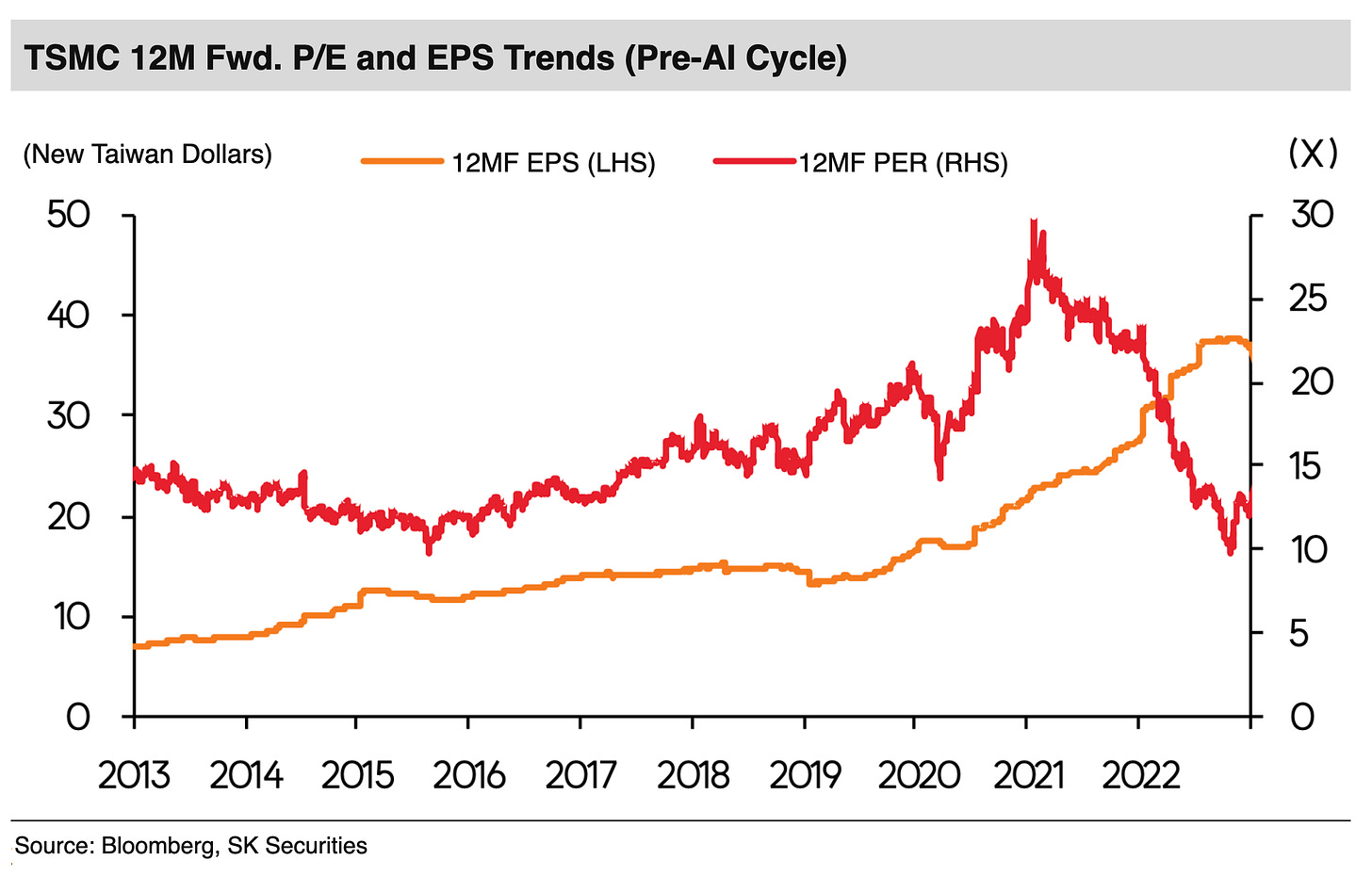

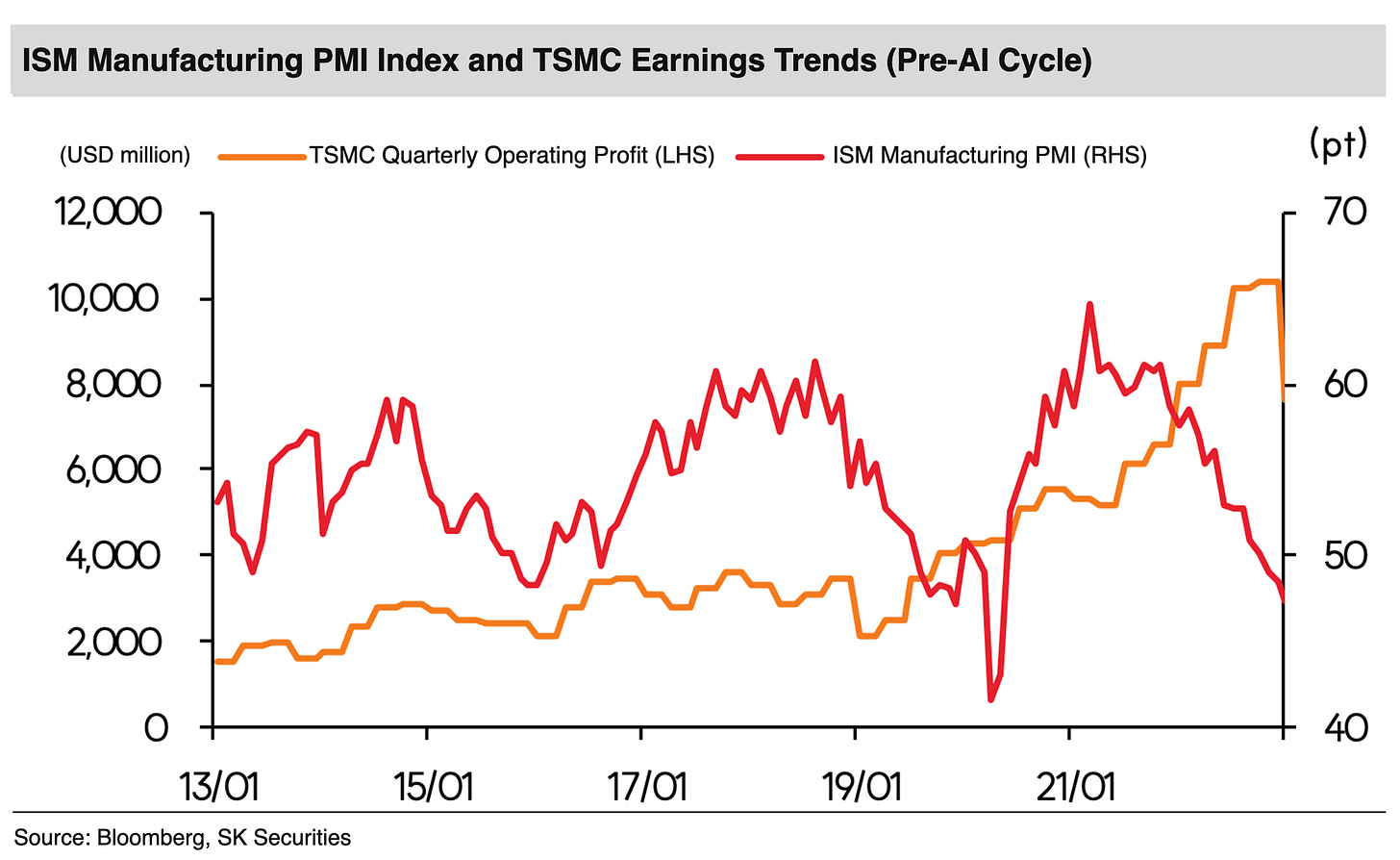

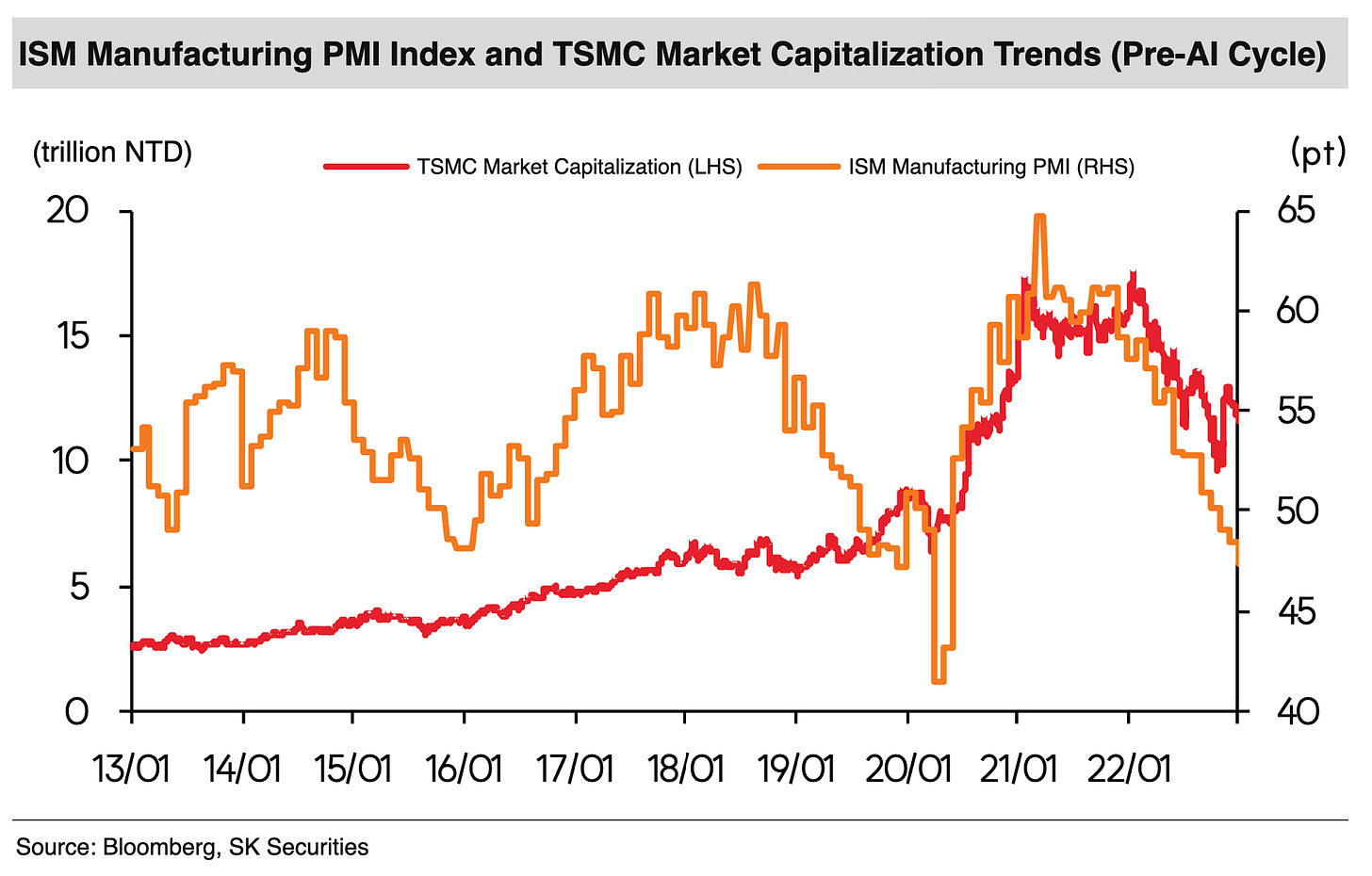

The valuation methodology for memory stocks was PBR. Because downturns and upturns were stark, confidence in the long-term trajectory of earnings was low. It was a cyclical industry linked to the macroeconomy. TSMC, which shares the same industry and end markets, was different. Despite being in the same capital-intensive manufacturing industry, it continued stable growth. Confidence in medium- to long-term earnings justified the application of PER.

Why is earnings volatility so high: build-first, order-later structure

In memory, a “build first, take orders later” structure is typical. Suppliers expand capacity by forecasting future demand on their own. Since the actual volume of demand is determined by the macroeconomy, suppliers ultimately have to match the macro. That is impossible. Large-scale memory capacity additions meant impending oversupply. TSMC follows an “order first, expand later” structure. Within specialties and technological differentiation, it expands on an order basis and is less sensitive to macro slowdowns. Large-scale expansions at TSMC signaled upward revisions to forecasts.

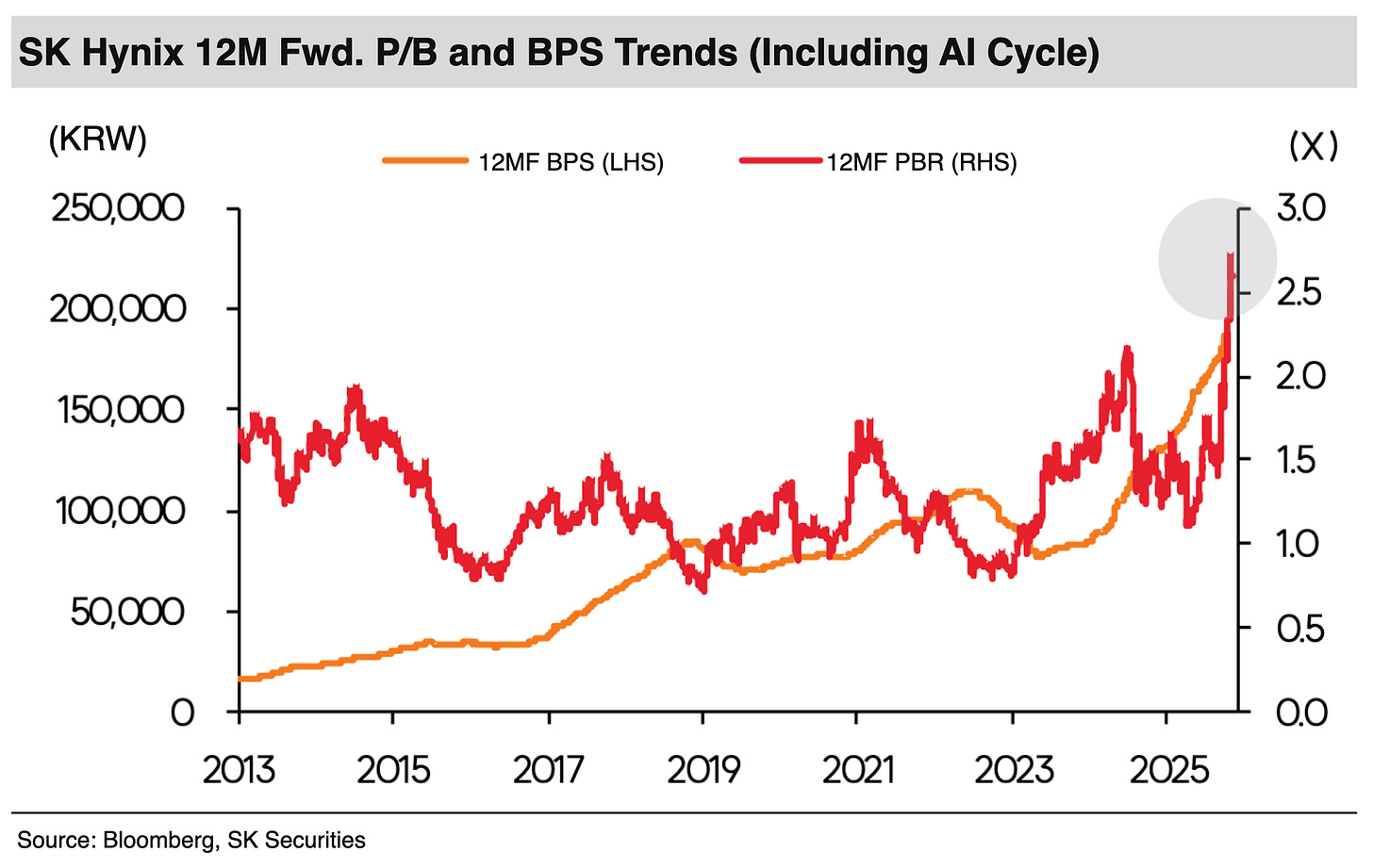

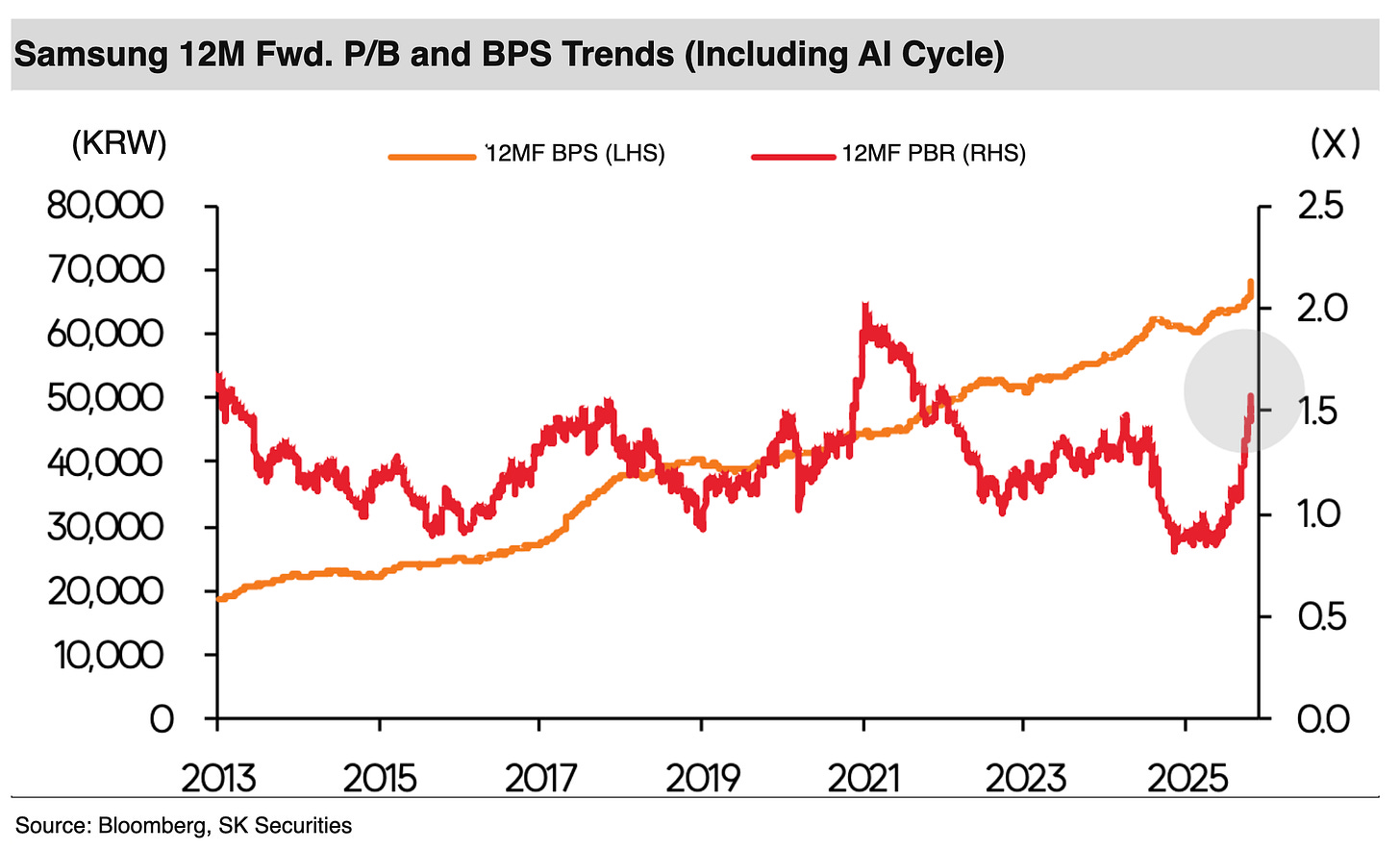

Signal of value expansion: the PBR ceiling has begun to be breached

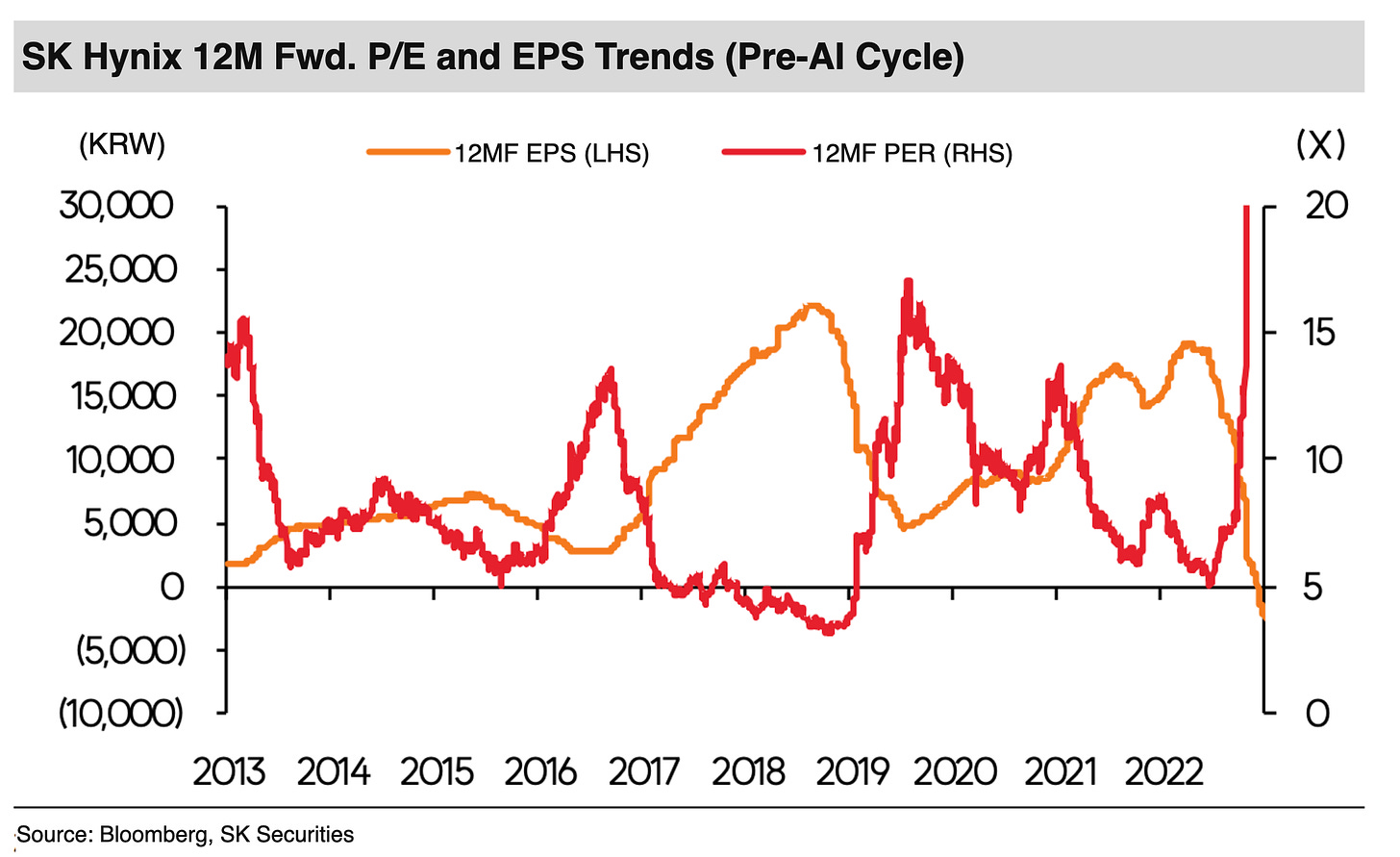

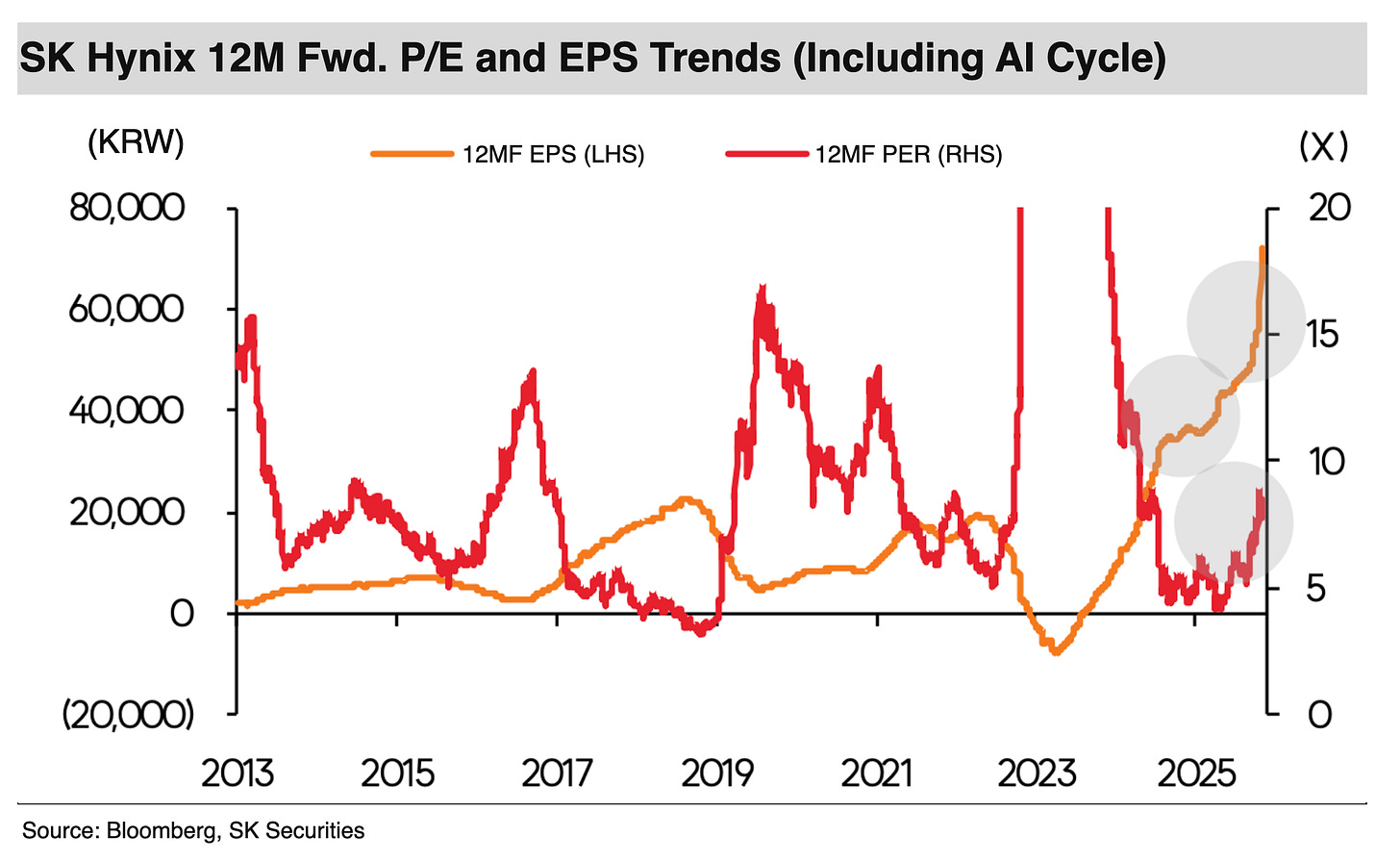

In the AI cycle, PBR has started to lose its explanatory power for memory share prices. SK Hynix, which has been consistently achieving differentiated profits based on HBM, has seen its PBR begin to break above its historical ceiling. EPS and PER are also rising together. Considering that PER typically fell during upswings when EPS was being revised up, this is judged to be a signal of value expansion.

From now on, PER: structural expansion of earnings stability and growth

Memory will also transform into an order-first, expand-later structure. The start of the AI scale-out cycle is expanding the memory benefit beyond HBM to memory overall, including server DRAM and SSDs. It is an even stronger cycle than the past two years. By contrast, given the lack of room for capacity additions, a flexible increase in supply will be difficult. Without stable procurement of memory, achieving AI roadmaps is impossible. The share of long-term supply contracts of about 2–3 years will now expand rapidly. In the AI cycle, memory is PER.

New paradigm, New multiple: a new path

If the industry has changed, the method of valuing companies should also change. Applying PER, the target prices presented by SK Securities are KRW 170,000 for Samsung Electronics and KRW 1,000,000 for SK Hynix.

1. Why was the memory valuation tool PBR

Cyclical: high earnings volatility

Historically, the valuation tool for memory stocks was PBR.

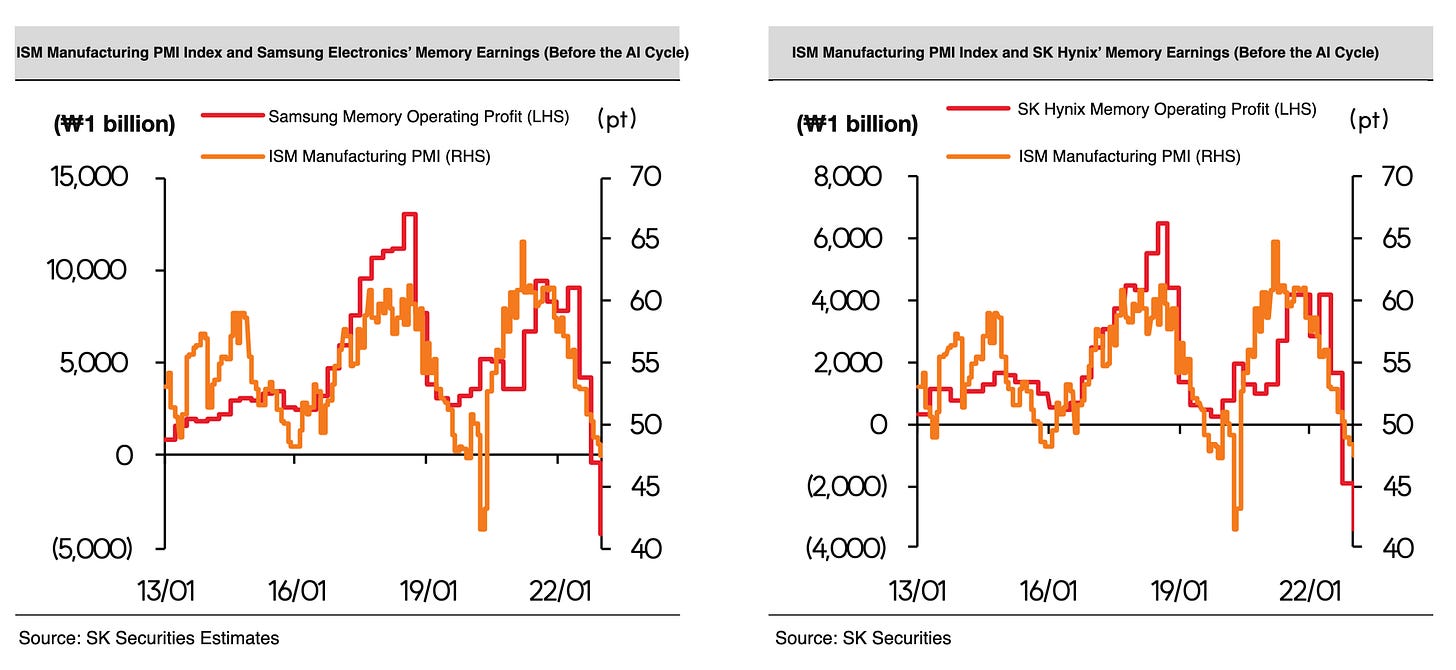

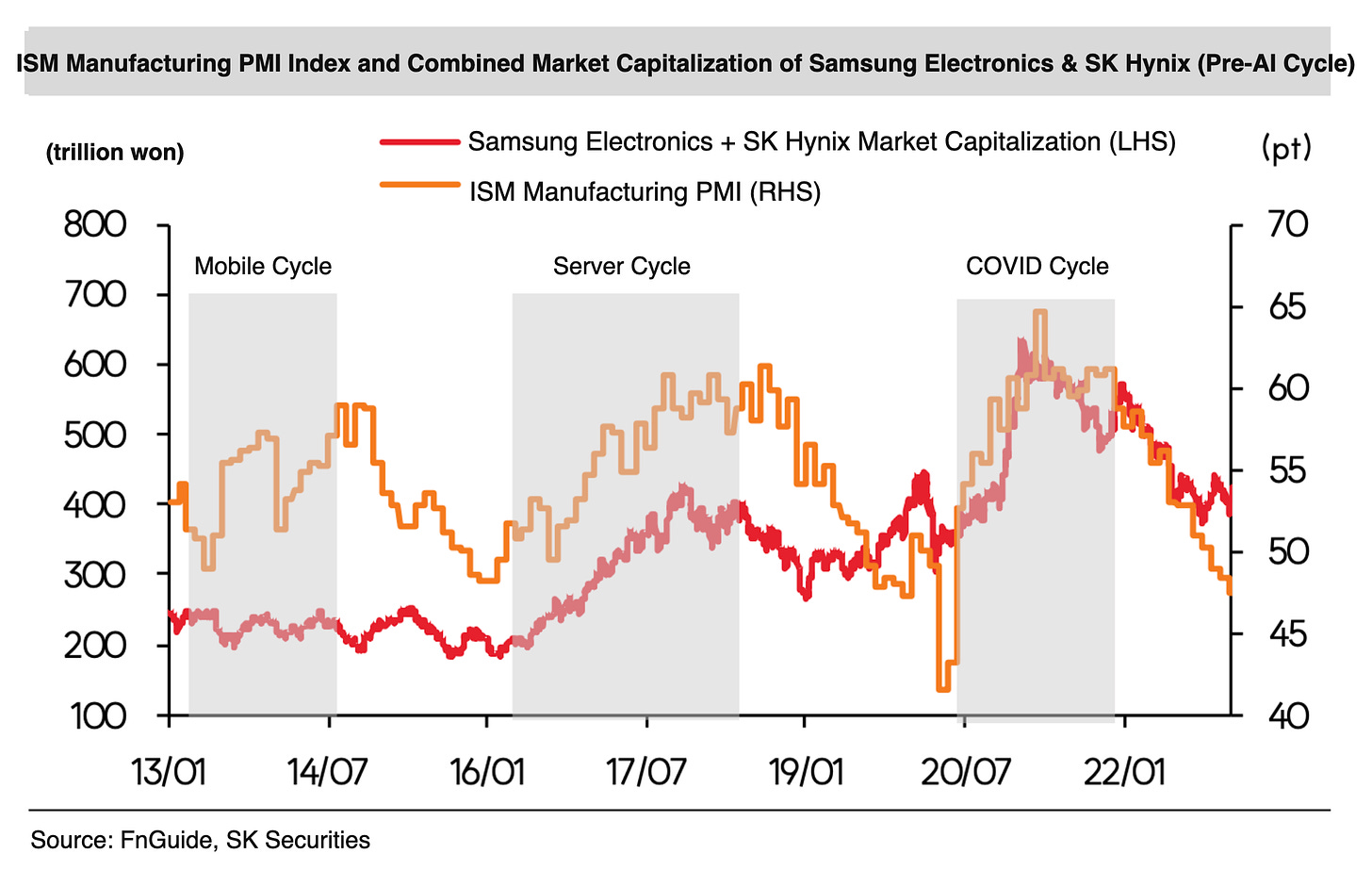

As the memory industry went through the early-2010s smartphone cycle, followed by the server and COVID cycles, the contrast between downturns and upturns was stark. Because a large share of costs in the memory industry are fixed, the high profit elasticity to memory price fluctuations was a double-edged sword. A Valuation based on the more stable Book value, rather than highly volatile Earnings, was effective.

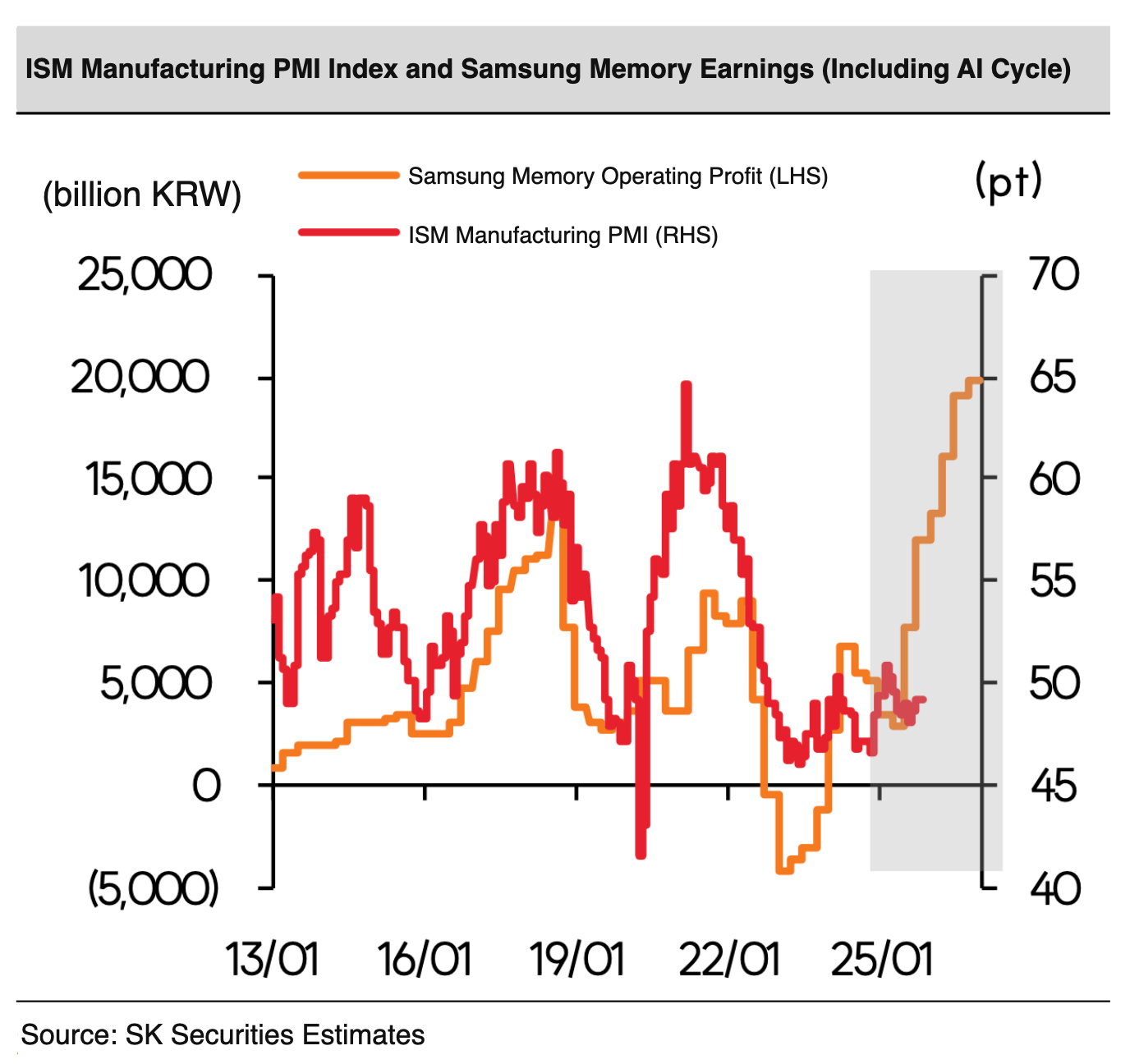

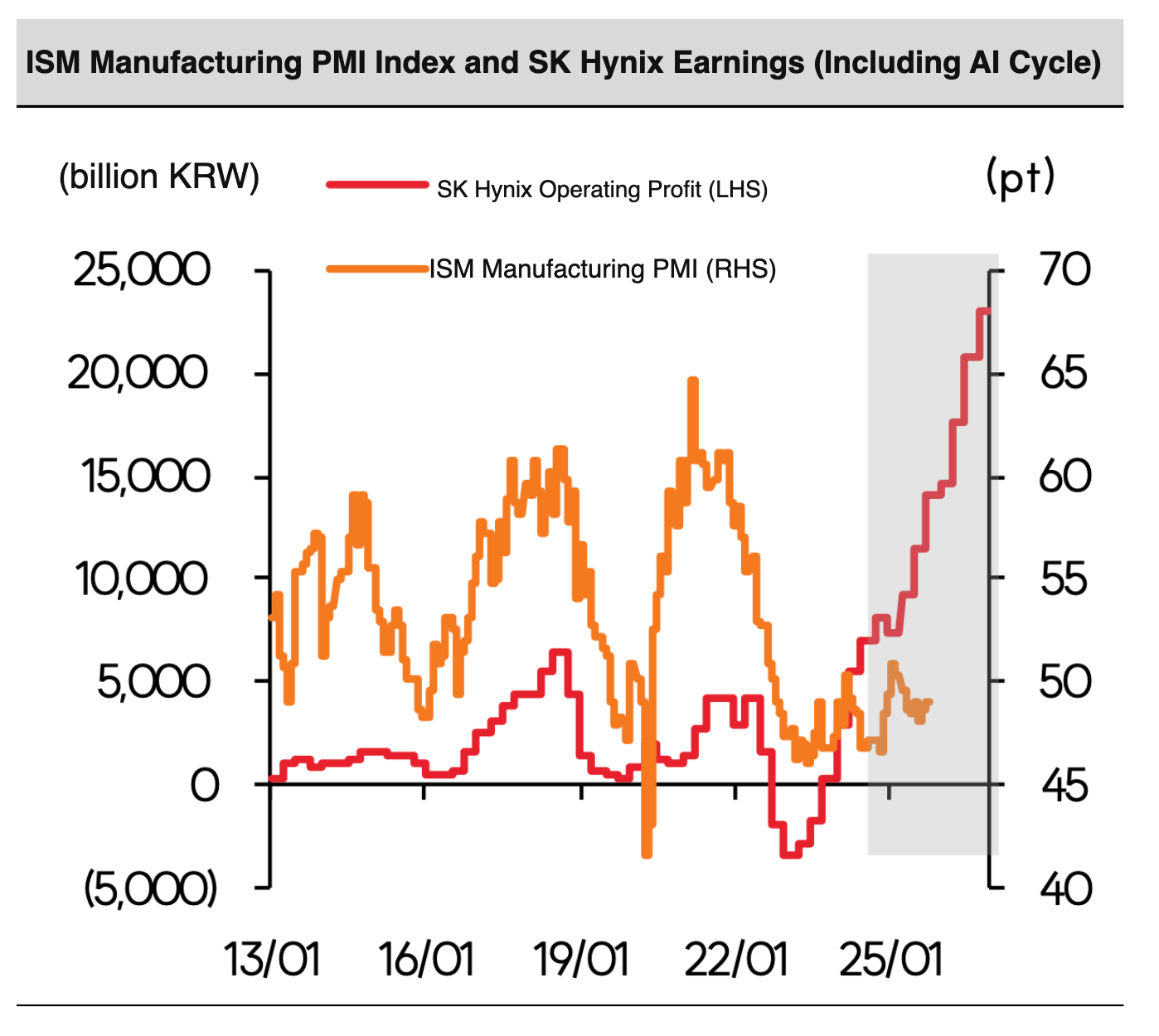

It was also a typical Cyclical industry linked to the macroeconomy.

From 2010 until the pre-AI cycle, no cycle deviated from the direction of the macroeconomy. The same held for earnings and share prices. In that process, PBR explained share prices well.

But TSMC was different.

Despite the same cycles, the same end markets, and the same capital-intensive manufacturing industry, TSMC continued stable growth. High confidence in stable profit growth provided the basis for applying PER Valuation. TSMC’s share price is well explained by PER.

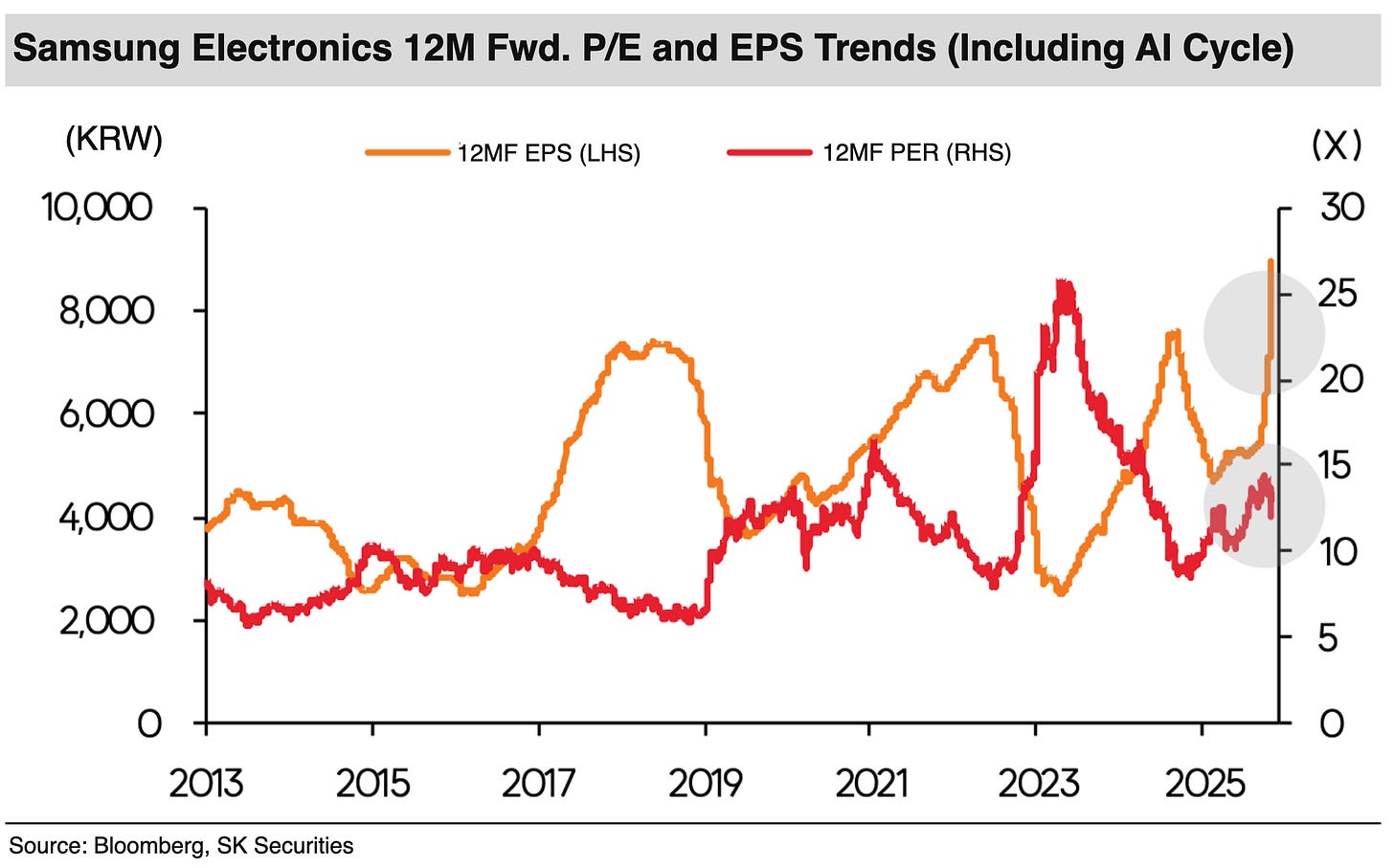

The same holds for the directions of PER and EPS within a cycle.

In an upcycle, while the direction of EPS increases is the same, the memory sector typically derates to a low PER even as EPS enters a full-fledged upward trend. The reason share prices still rise in this phase is that the slope of the EPS increase exceeds the slope of the PER decline. This implies that once the slope of EPS growth in the memory sector begins to slow, stock returns deteriorate.

The reason PER was low during booms has been confirmed by the subsequent sharp drops in earnings. PER failed to explain stock performance in the memory sector; if anything, buying high-PER and selling low-PER proved more effective. The cause is high earnings volatility and low stability.

The background is that memory follows a build-first, order-later structure.

In the build-first process, suppliers forecast future demand on their own and increase future supply through capacity expansion. Given that the actual volume of demand has been determined by the macroeconomy, suppliers effectively have to match the macroeconomy. This is virtually impossible.

Moreover, in periods when memory is standardized and the technological gap among vendors narrows, what remains is a battle for market share. Large-scale capacity additions mean imminent oversupply, which further amplifies industry volatility.

By contrast, TSMC follows an order-first, expand-later structure. Based on specialties and clear technological superiority, it expands capacity to respond to orders, so earnings volatility tied to the macroeconomy is low. This is generally why TSMC’s earnings and share price are insensitive to economic slowdowns, and even with large-scale expansions, the market does not worry about oversupply.

2. Signal of value expansion

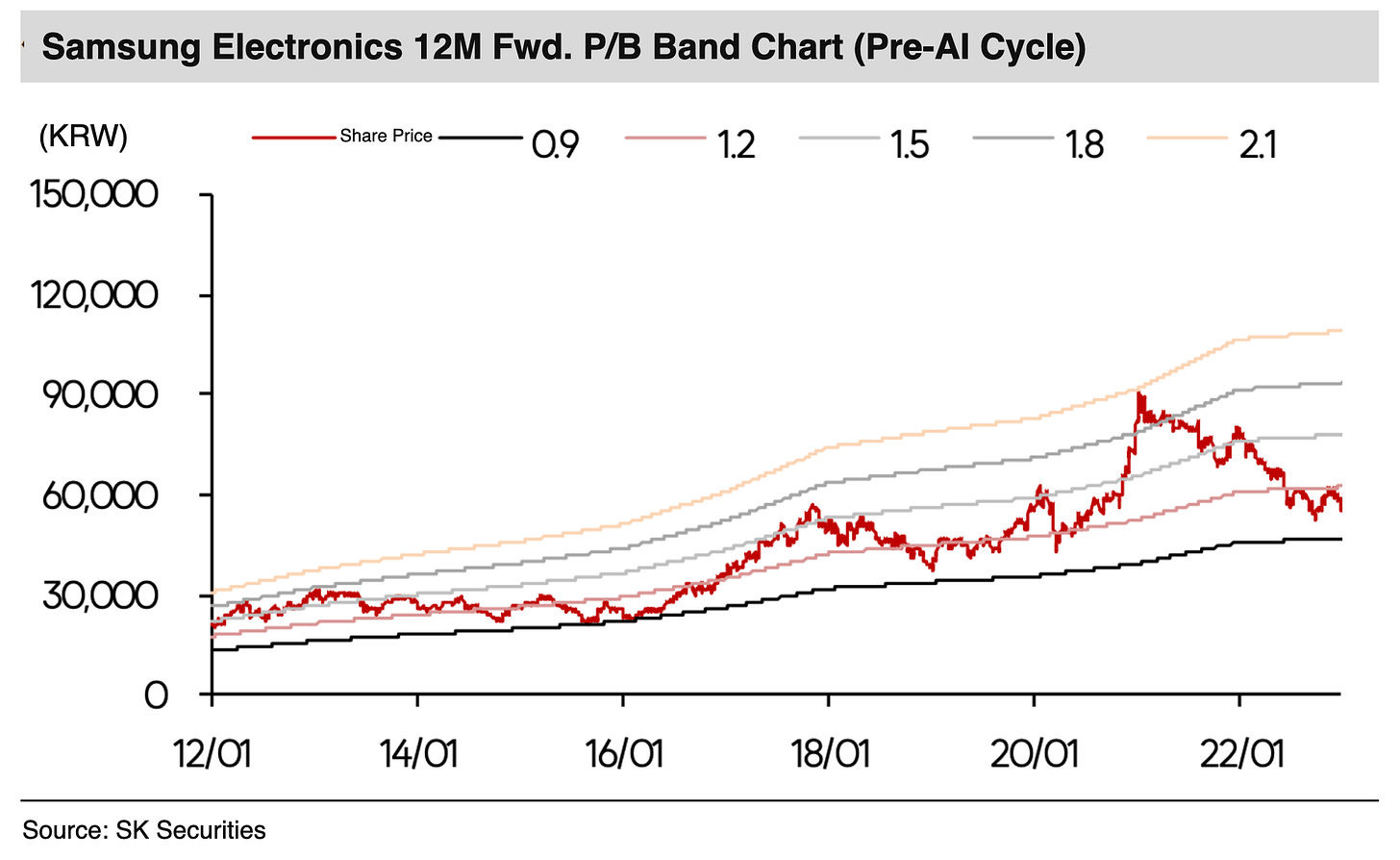

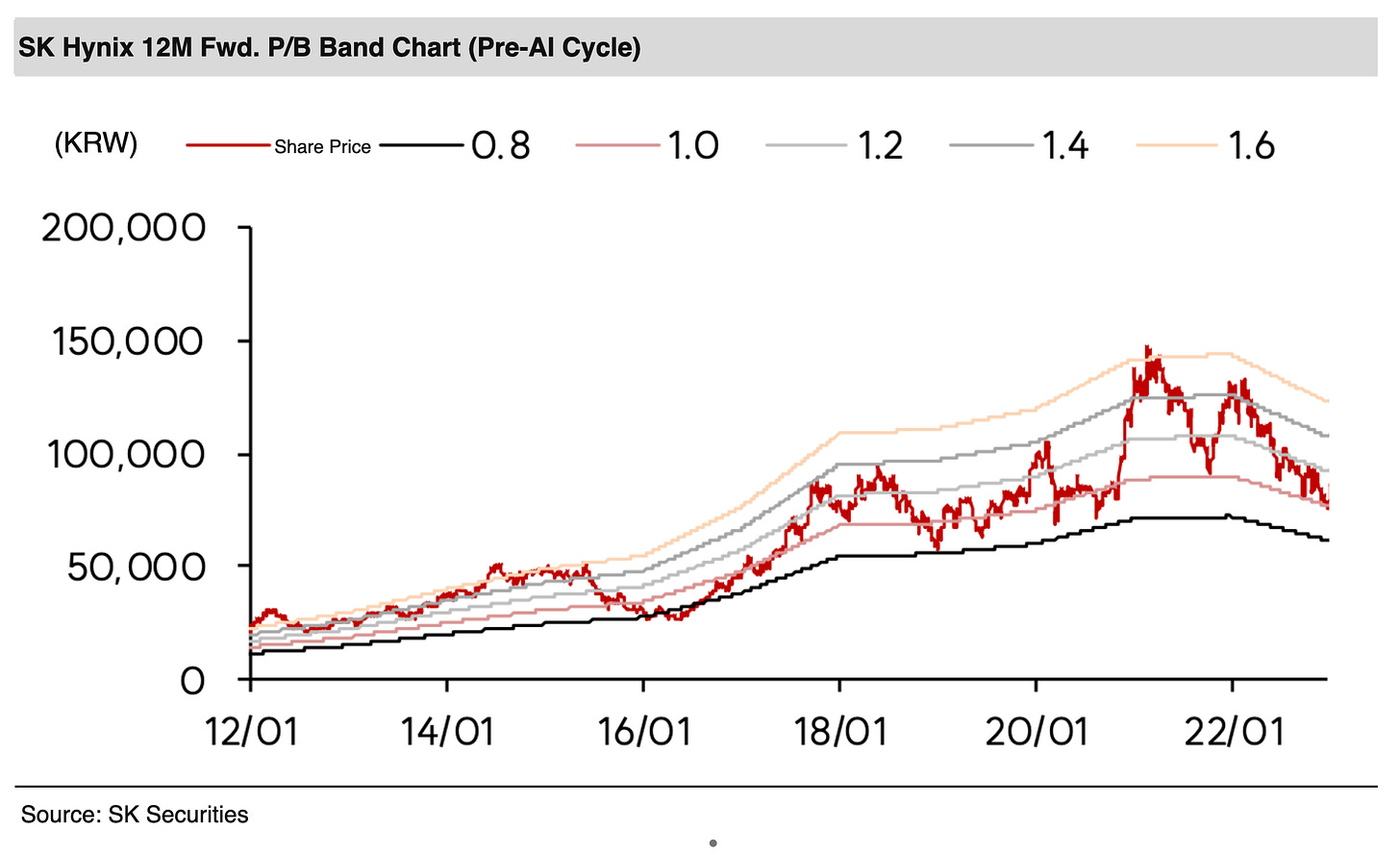

The traditional upper bound of the PBR band has already begun to be pierced

PBR, which has long explained the share prices of the memory sector, is beginning to lose its function.

This is because SK Hynix’s PBR, having delivered differentiated profits based on strong competitiveness in HBM since the start of the AI cycle,

has begun to break above the historical upper band.

Considering that it had not lost that function even once since 2010,

this shows that, in the AI cycle, a clearly different expansion of value from the past is underway.

Recently, upward revisions to EPS and a rise in PER have been occurring together in the memory sector.

In the past, cases where upward EPS revisions and PER increases occurred together in the memory sector were the phase when the cycle

was beginning to turn from downturn to upturn. In this period, expectations of a resilient rebound in conditions

are reflected in share prices, so the elasticity of share-price gains exceeds the magnitude of the EPS revisions. Except for this case,

it is generally low PER in booms and high PER in downturns.

The memory sector is not currently in a phase turning from downturn to boom. Since the start of the AI

cycle in 2023, the industry began to turn around, and the boom has continued up to recently. We judge that we are at the outset where

the assessment of the memory sector within the AI cycle is beginning to change rapidly.

It is time to consider whether maintaining PBR valuation for the memory sector is appropriate.

If the basis for PBR was high earnings volatility, then as earnings stability strengthens within the AI cycle and structural

growth becomes prolonged, PBR will gradually begin to lose its rationale.

Change in valuation methodology: now PER

Change in the character of the memory industry: lower volatility, a cycle that beats the macroeconomy

Within the AI cycle, the character of the memory industry is changing fundamentally.

Since the start of the AI cycle in 2023, SK Hynix, which preempted the HBM market, has seen its earnings trend upward regardless of the macroeconomy. In 2023, this was interpreted as a base effect, as it was a phase of passing through the worst conditions represented by production cuts. However, this trend has continued for two years.

SK Securities forecasts that the structural profit-increase cycle for the memory sector within the AI cycle will continue at least until 2027. This is because the core of the AI cycle is expanding from the existing scale-up to scale-out, lifting demand, while the room for supply to rise is limited.

With CapEx discipline and HBM strength, and a lack of space available for capacity additions, the start of the scale-out cycle means a prolongation of supplier advantage. In October’s NDR, NVIDIA projected that global data-center CapEx could grow at up to a 40% annual average rate from 2025 to 2030. The AI cycle will expand from scale-up to scale-out and scale-across.

In the process, AI memory will begin to diversify not only through increased HBM adoption but also into server DRAM, GD7, SOCAMM2, and Custom HBM, and the intensity of AI benefits across the overall memory sector is expected to rise sharply.

This implies that the memory industry will shift to an order-first, expand-later structure. Achieving AI roadmaps is impossible without a stable supply of memory. Securing AI-specialized memory such as SOCAMM2 and Custom HBM is also extremely important. Amid limited capacity for supply increases, the share of long-term supply contracts of about 2–3 years to secure various AI memories stably will rise rapidly. The likelihood that memory capacity additions, as in the past, will become the trigger for a peak-out in conditions is low.

SK Securities changes the valuation methodology for the memory sector within the AI cycle to PER. This is because declining earnings volatility, enhanced long-term growth, and profit trends that beat the macroeconomy will begin to raise confidence in earnings. This also implies a structural rise in EBITDA, which is expected to lead to strengthened shareholder-return policies in the memory sector.

This will, in turn, re-justify the higher corporate value that accompanies the shift to PER.

3. New paradigm, New multiple

At the threshold of a new path

SK Securities changes the valuation methodology for Samsung Electronics and SK Hynix to PER.

Accordingly, it raises the target prices to KRW 170,000 for Samsung Electronics and KRW 1,000,000 for SK Hynix.

Applying target PERs of 15X and 11X, respectively, to the two companies’ 2026 expected EPS,

the target prices are revised up by 55% and 108%.

Since applying PER to Korean memory names is the first phase, a period of doubt about the rationality

of the target PER levels is inevitable.

However, as the AI cycle expands from scale-up to scale-out and scale-across, it is a phase in which

memory demand is being driven explosively. By contrast, the suppliers’ limited ability to increase supply

means a prolongation of a price-up-centered cycle. We judge that this is the time when the earnings

growth rate of the memory sector will begin to stand out most conspicuously among global AI-related stocks.

In the AI scale-out cycle, Samsung Electronics will generate upside in general DRAM based on a production-capacity advantage,

and SK Hynix will actively leverage synergy with general DRAM amid the continuation of its competitive edge in HBM.

Both companies can pursue profit maximization.

Considering this, the PERs of memory suppliers such as Samsung Electronics, SK Hynix, and Micron are inexpensive

relative to the PERs of TSMC and NVIDIA, the key beneficiaries in global AI.

Also, Samsung Electronics’ target PER of 15X is the upper end of its historical 12M Fwd. P/E band,

and SK Hynix’s target PER of 11X is below Micron’s 2026 expected PER of 13X, so they are not excessive.

In the AI cycle, the character of the memory industry is changing structurally.

It has been about two years since the earnings trend began to change, and the cycle is strengthening.

As confidence in a foundation of stable earnings growth rises, the methodology for valuing corporate value must also change.

SK Securities maintains its previously presented view of a memory supercycle.

We interpret the recent steep share-price gains not as a temporary phenomenon, but as the beginning of the reflection

of structural changes in the industry. Supercycle, Buy all.