Why do I feel a sense of fear when I see OpenAI’s DRAM orders?

The memory cycle doesn’t last forever.

OpenAI’s indicated monthly DRAM demand of 900K units is understood to be based on 2029 projections, according to sources.

As of the end of 2025, the global DRAM capacity is estimated to be around 2,000K.

That means the demand presented by OpenAI would account for roughly 45% of the total.

For the high-value DRAMs (including HBM) that OpenAI requires, only the three major DRAM manufacturers are capable of supplying them. Based on the effective capacity of these three companies, the share rises to 63%.

However, this raises one particular concern for me.

It reminds me of the memory supercycle of 2017.

Back then, Amazon (AWS) urged Samsung to build a memory fab dedicated to its needs, implying massive DRAM demand to come.

But when Samsung completed the fab in 2018–2019, Amazon never actually placed those orders, as if nothing had happened.

As a result, Samsung was left with idle capacity, and those unused fabs quickly turned into enormous depreciation burdens and heavy losses.

That’s how we fell into the memory downcycle that lasted until 2020.

My point is this: during booms, everyone insists that demand will keep soaring and pushes semiconductor makers to make huge investments.

But when the cycle turns for whatever reason, those same players simply stop ordering — and those investments translate directly into losses.

The more aggressively you invest during the boom, the deeper the losses become when the downturn hits.

A bit off-topic, but one of the members in my Discord once shared an interesting idea with me.

(If you become a Founding Member, you can join my Discord! It includes several hedge fund professionals, sell-side analysts, and people working in the semiconductor industry.)

He said: “Google is doing so well with its TPU that maybe NVIDIA and AMD won’t be able to sell shovels anymore.”

So this time, when NVIDIA invested as much as $100 billion into OpenAI, and AMD offered OpenAI equity just to establish ties, maybe both of them are desperately trying to bind themselves to OpenAI in order to fend off the threat of ASIC-based competitors.

And then another thought hit me:

Not everyone can be a winner in AI.

There are challengers like xAI, Anthropic, and OpenAI — but the crown can only sit on one head.

Eventually, someone will drop out of the race. The question is — who and when?

One thing seems certain: this AI arms race can’t last forever, and the number of people willing to buy shovels isn’t infinite.

In other words, once one of them falls out of the race, could that be when GPU and HBM prices start to collapse?

Lately, I’ve been feeling anxious about that. Like Buffett said, “Only when the tide goes out do you discover who’s been swimming naked.” Those words keep echoing in my head.

Anyway, let’s get back to the main topic.

What does the easing of the separation between industrial and financial capital mean?

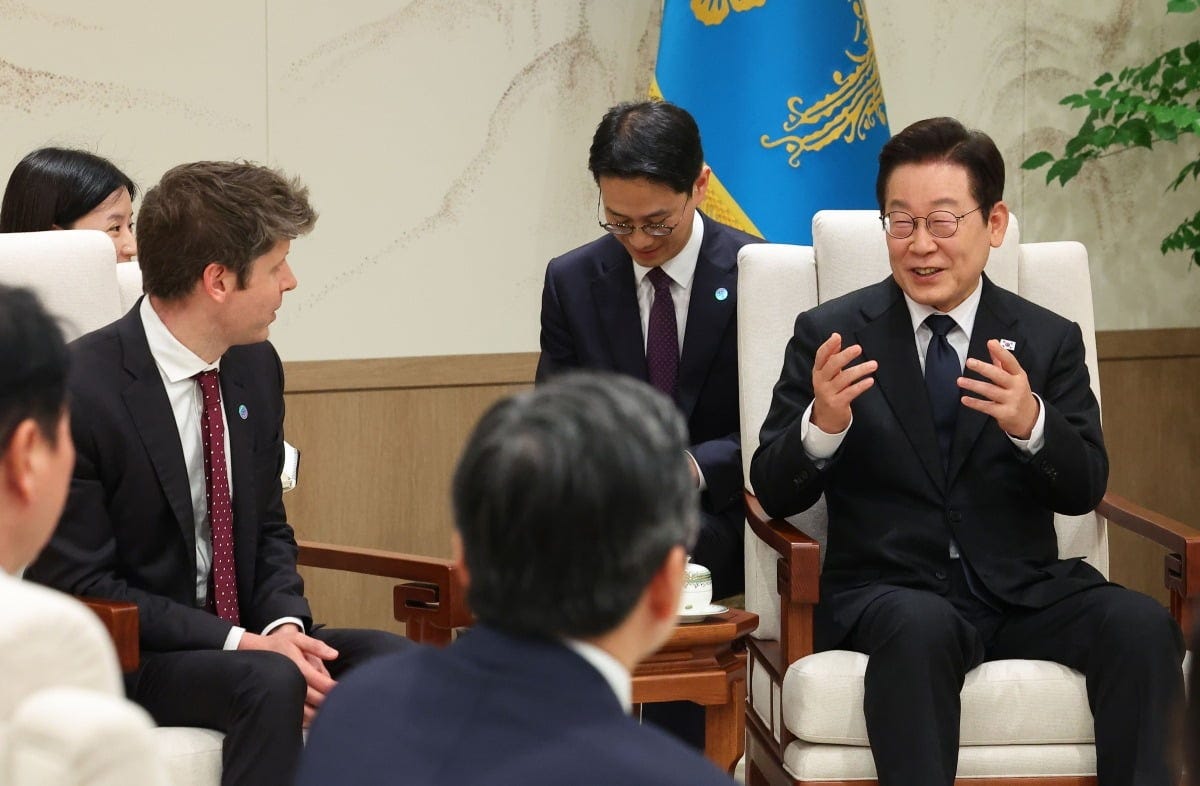

President Lee Jae-myung of South Korea has instructed his administration to “review the easing of the separation between industrial and financial capital.”

He made this remark during a meeting with Sam Altman, CEO of OpenAI, on the 1st.

The separation of industrial and financial capital is a regulation introduced in 1982 to keep industrial conglomerates and financial institutions apart.

President Lee cited “securing investment capital for semiconductors” as the main reason for reviewing the policy.

But what does the separation of industrial and financial capital have to do with semiconductors?

To understand the background of President Lee’s remarks, we need to start with SK Hynix.

SK Hynix, which has risen to become a “semiconductor superstar” in the age of artificial intelligence (AI) thanks to its high-bandwidth memory (HBM), faced a severe crisis just two to three years ago — to the point where its very survival was in question. The company was hit hard by a brutal memory downturn.

In 2022, its operating profit of 6.81 trillion won plunged 45.1% from the previous year’s 12.41 trillion won. In 2023, it even recorded an operating loss of 7.73 trillion won. The situation was so dire that rumors spread throughout the industry that “SK Hynix might not survive.”

It was HBM that saved SK Hynix.

As the era of generative AI began in late 2022, demand for HBM started to surge explosively. From 2023 to 2024, SK Hynix effectively monopolized HBM orders from major customer NVIDIA, barely making it through the harsh memory downturn.

Then, in 2024, the company posted an enormous operating profit.

Yet, despite that success, SK Hynix’s management could not hide their growing sense of unease.

To handle the flood of HBM orders pouring in from customers such as NVIDIA, the company had to rapidly expand its production capacity. However, manufacturing HBM requires an enormous amount of capital — in other words, more investment spending.

Although SK Hynix’s performance began to recover in 2024, the company was still short on cash.

So the idea conceived by SK Hynix’s top leadership was to create a fund dedicated to semiconductor facility investment.

The SK Group would establish special-purpose companies (SPCs) to build semiconductor fabs or purchase equipment, and then set up funds to attract investments from major global firms such as BlackRock and Blackstone.

The profits generated through these ventures would be distributed to investors.

While it meant the company wouldn’t be able to keep all the profits, they judged it to be a better option than being unable to expand production capacity due to a lack of funds — and ultimately having to hand over HBM orders to competitors.

However, this plan was soon blocked by South Korea’s regulations on the separation of industrial and financial capital.

Under Korean law, industrial conglomerates like the SK Group are prohibited from acting as general partners (GPs) to create funds and raise external capital.

But now, with President Lee Jae-myung mentioning the potential easing of these restrictions, there’s a possibility that SK Hynix’s original proposal could finally come to life.

However, I have some concerns about this.

As I mentioned earlier, memory is a cyclical industry — and no one knows how long this boom will last.

Historically, investments made during upcycles have almost always exceeded optimal levels, which in turn led to massive losses during downturns.

Now, SK Hynix is bringing leverage into the picture.

In the past, most memory industry investments were financed directly from companies’ own cash reserves. That allowed them to weather downturns even after periods of overinvestment, since the losses weren’t catastrophic.

But things change once leverage enters the equation. The scale of investment will grow much larger — and so will the risks.

Whether this capital comes from Korean banks or Wall Street remains to be seen.

I just hope that by the time this plan materializes, around 2029, the current cycle will still be intact and everyone in the industry will be thriving.

I sincerely hope my uneasy feeling doesn’t become reality.

In the paywall section, we’ll take a more rational approach — using actual data to forecast where the memory cycle might pause, and how far it could flourish.

Keep reading with a 7-day free trial

Subscribe to SemiconSam to keep reading this post and get 7 days of free access to the full post archives.

![한미AI동맹] 샘 올트먼 만난 이재용…삼성, 오픈AI와 `A 데이터센터` 삼위일체 - 디지털데일리 한미AI동맹] 샘 올트먼 만난 이재용…삼성, 오픈AI와 `A 데이터센터` 삼위일체 - 디지털데일리](https://substackcdn.com/image/fetch/$s_!VDF2!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F60ceab87-db58-4327-b89c-524a3e10907c_640x427.jpeg)