Samsung Securities HBM Analysis (2025,5,15)

A collection of data on HBM outlook, demand, supply, and more

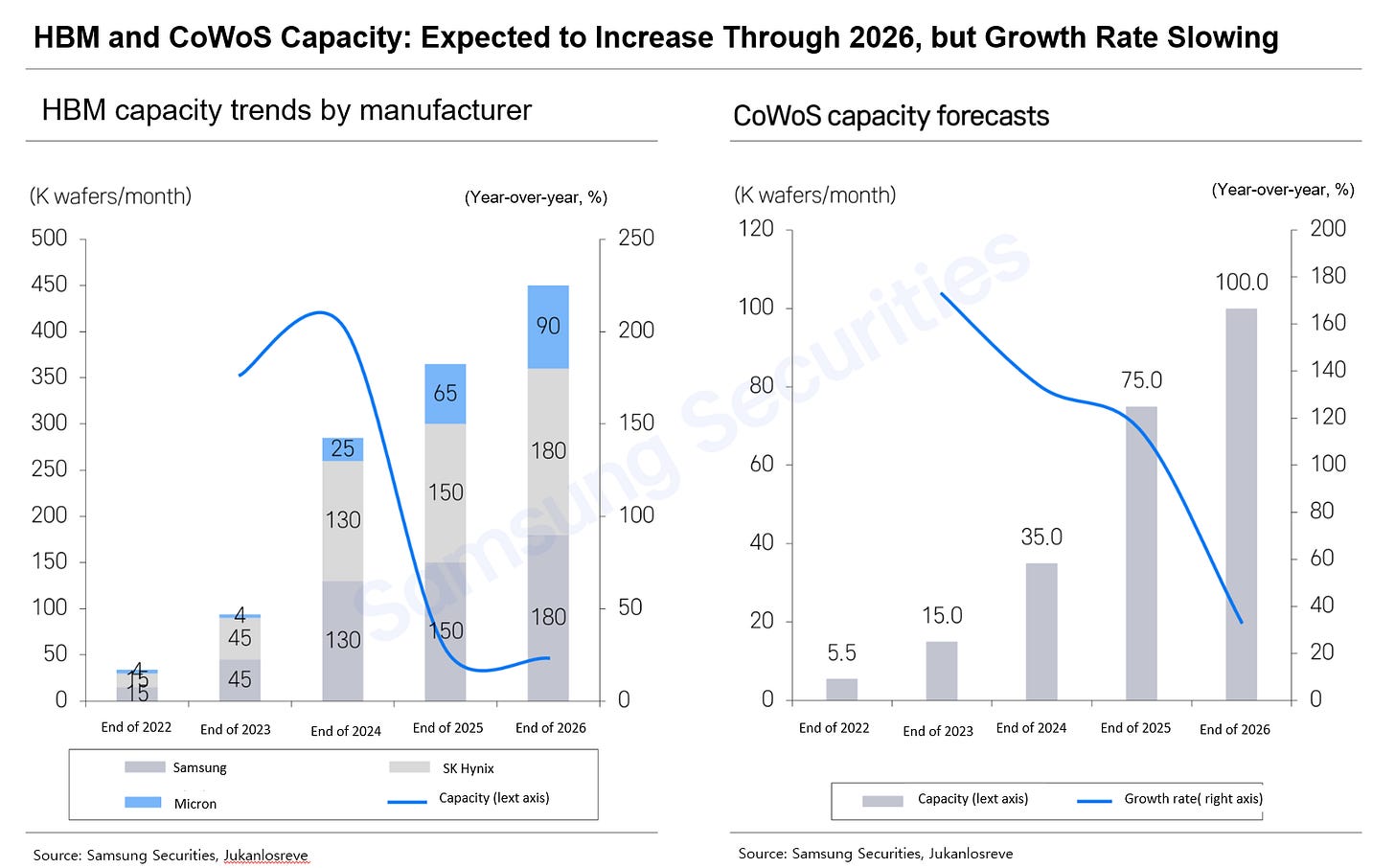

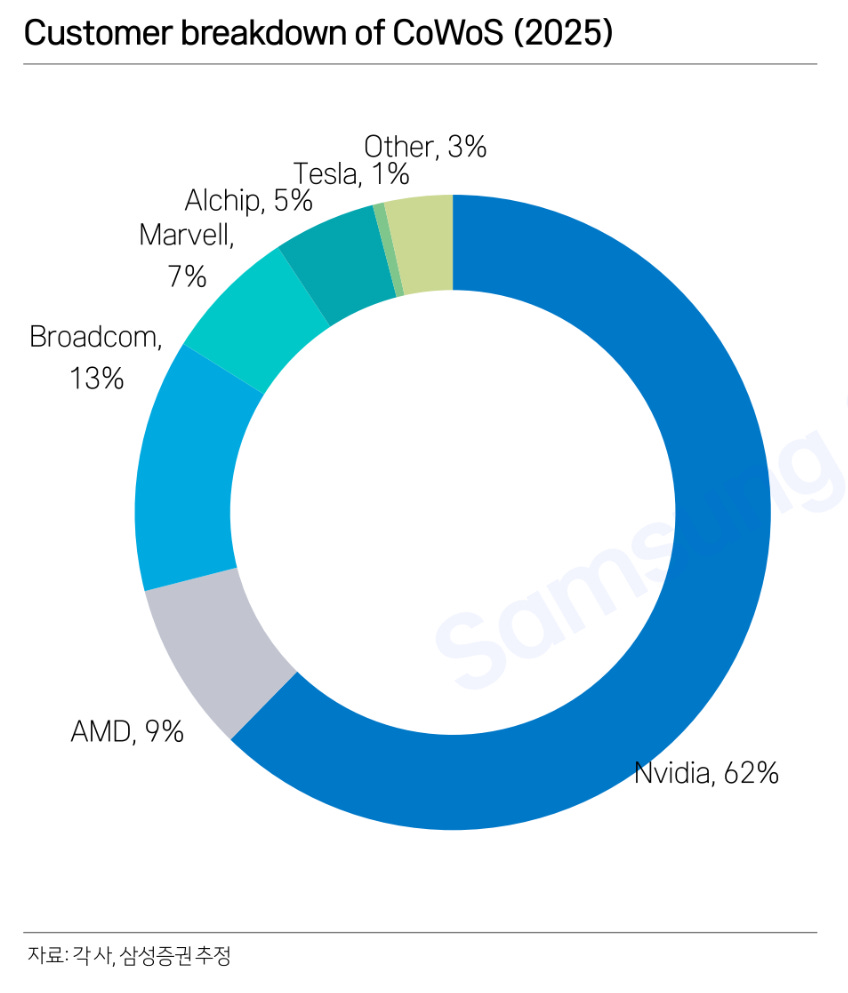

HBM and CoWoS Capacity: Expected to Increase Through 2026, but Growth Rate Slowing

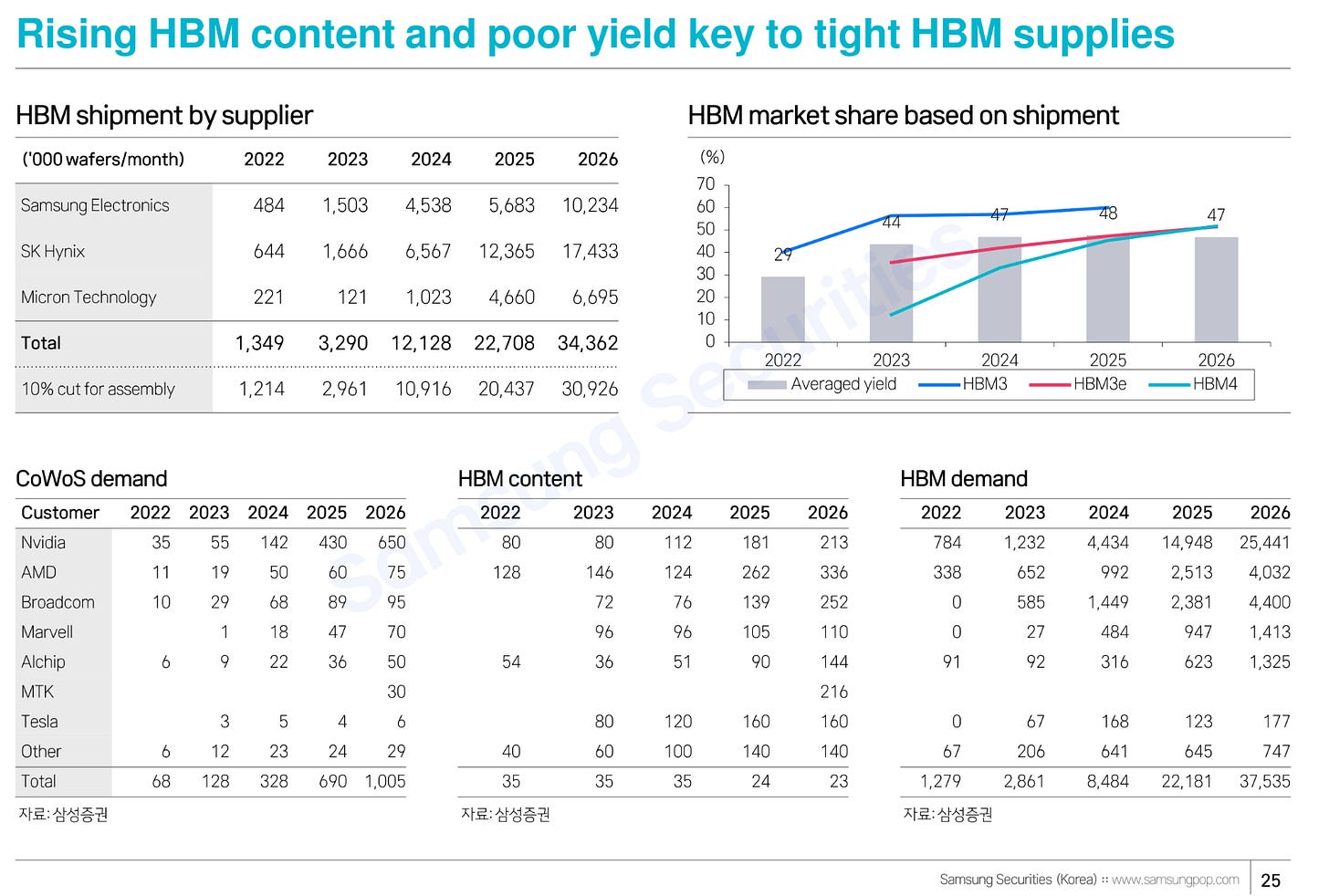

HBM Supply: Additional Capacity Expansion Potential for SK Hynix and Micron in 2026

By the end of 2025, Samsung Electronics and SK Hynix are expected to secure HBM capacity of approximately 150K wafers/month.

• Samsung Electronics: Initially expected to secure 170K wafers/month by the end of 2025, but revised downward to 150K wafers/month. Accordingly, shipment forecast also lowered from 80 billion Gb to 60 billion Gb.

• SK Hynix: Initially expected to secure 65K wafers/month by the end of 2025, but revised upward to 150K wafers/month. Additional expansion at M15× planned in 2026.

• Micron is expected to expand capacity to 25K wafers/month by the end of 2024, 65K by the end of 2025, and 90K by the end of 2026.

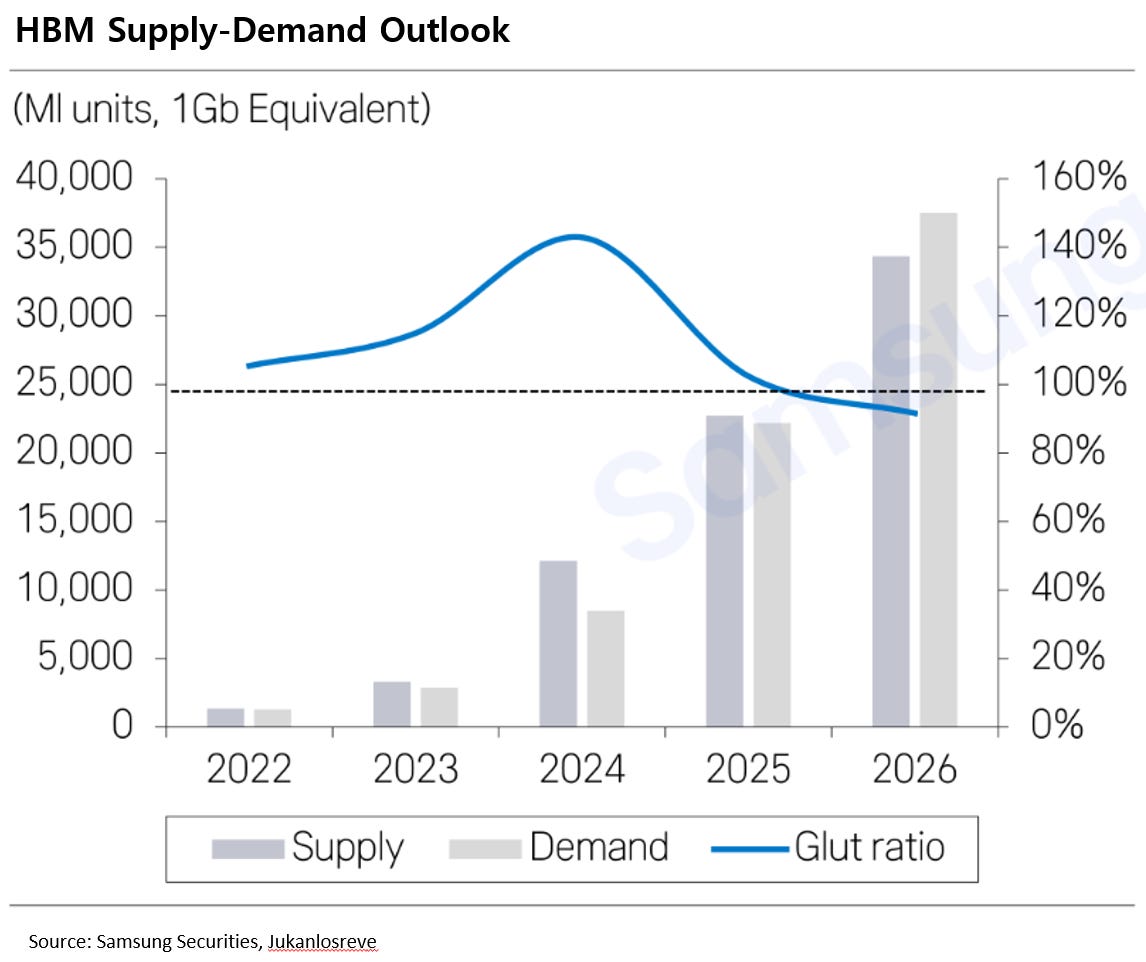

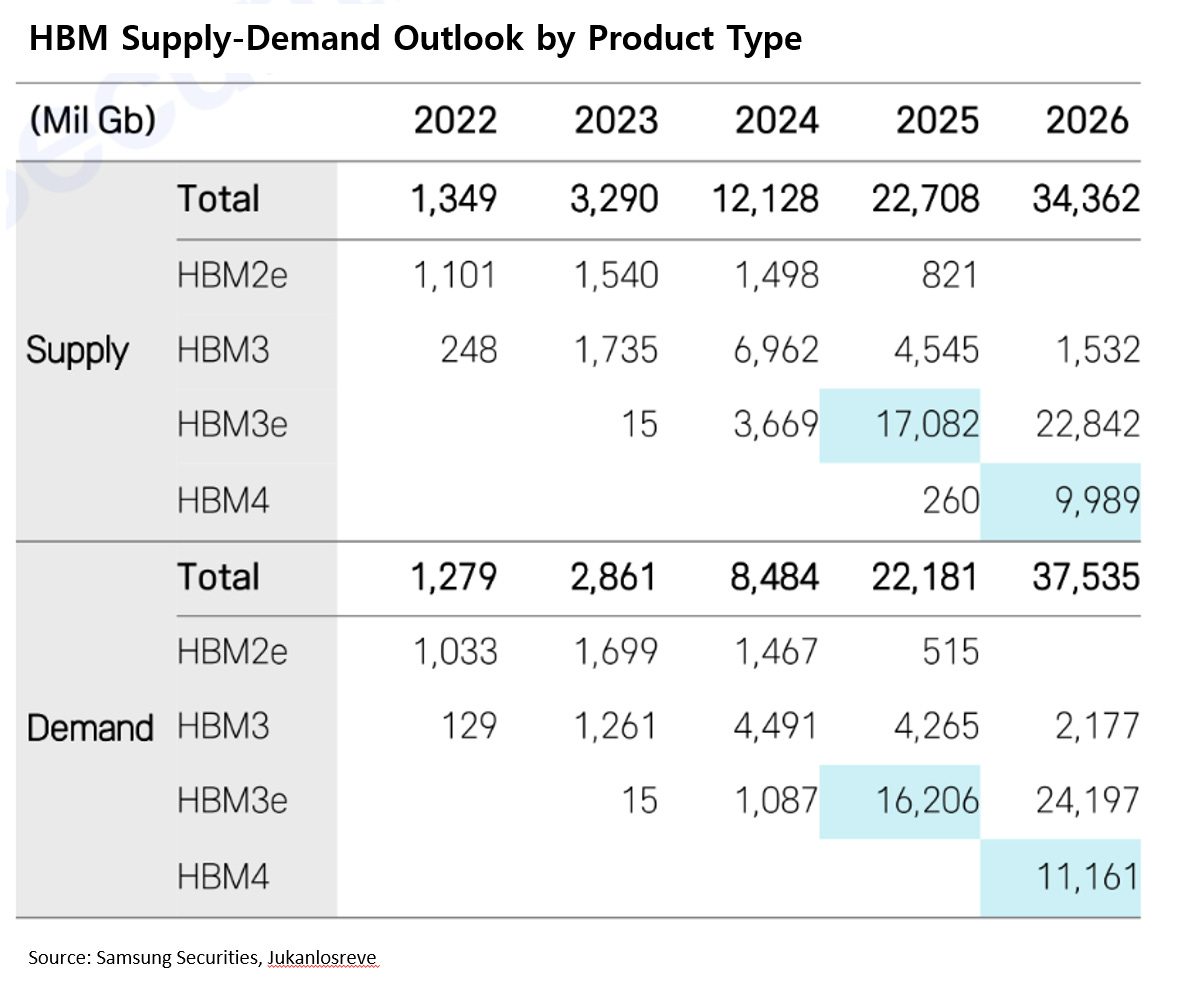

Expansion of HBM3e and HBM4 Markets Is the Biggest Variable

After 2025, demand for high-end HBM3e and above is expected to increase, driven by Blackwell (NVDA) and TPU (AVGO).

• Demand forecast: 5.3 million units of the Blackwell series and 2.2 million units of TPU v6 in 2025.

• The main reason for the demand increase is content growth:

1) DRAM content in Blackwell increases by 2x (H200 to B300) to 2.4x (H100 to B200),

2) DRAM content in TPU v6 increases 2x (compared to v5p).

▶ Demand for HBM3e and HBM4 is expected to outpace supply growth. Each technology should be calculated based on separate supply-demand dynamics.