Copper Foil: Mitsui’s near-monopoly is creating a supply shortage — and an unexpected beneficiary is emerging

Shortage signs are now emerging in copper-clad laminates as well, following glass fiber

This article is based on SK Securities’ report dated November 20.

Before I begin the main text, I will first explain what “copper foil” is.

Copper foil is a thin copper sheet made by rolling, and it can be broadly divided into two categories: battery copper foil and circuit copper foil for IT substrates. Battery copper foil is a thin copper sheet attached to the battery anode material,

and circuit copper foil serves as the copper circuit layer that forms PCB circuits. Circuit copper foil can be classified by substrate type: general-purpose rigid, mobile HDI,

FPCB, MLB substrates, and semiconductor packaging substrates, in that order of increasing added value.

Battery copper foil is an industry with over 100% excess supply. This is because Chinese companies have all rushed to expand capacity.

In contrast, circuit copper foil for substrates is a market where supply is limited to around five major manufacturers outside of China. In particular, for circuit copper foil used in semiconductor packaging substrates and server/network equipment substrates, Japan’s Mitsui is in effect a monopolistic supplier. It is not easy to convert production lines between battery copper foil and circuit copper foil. This is not a market where Chinese players can freely switch lines and ramp up supply just because it is profitable. While circuit copper foil is currently suffering from an acute shortage, if substrate demand increases, the shortage of circuit copper foil could become prolonged. Following glass fiber used in substrates, key materials such as gold plating and prepreg are also rising in price. For substrate/material categories, supply–demand is gradually tightening in tandem with rising costs.

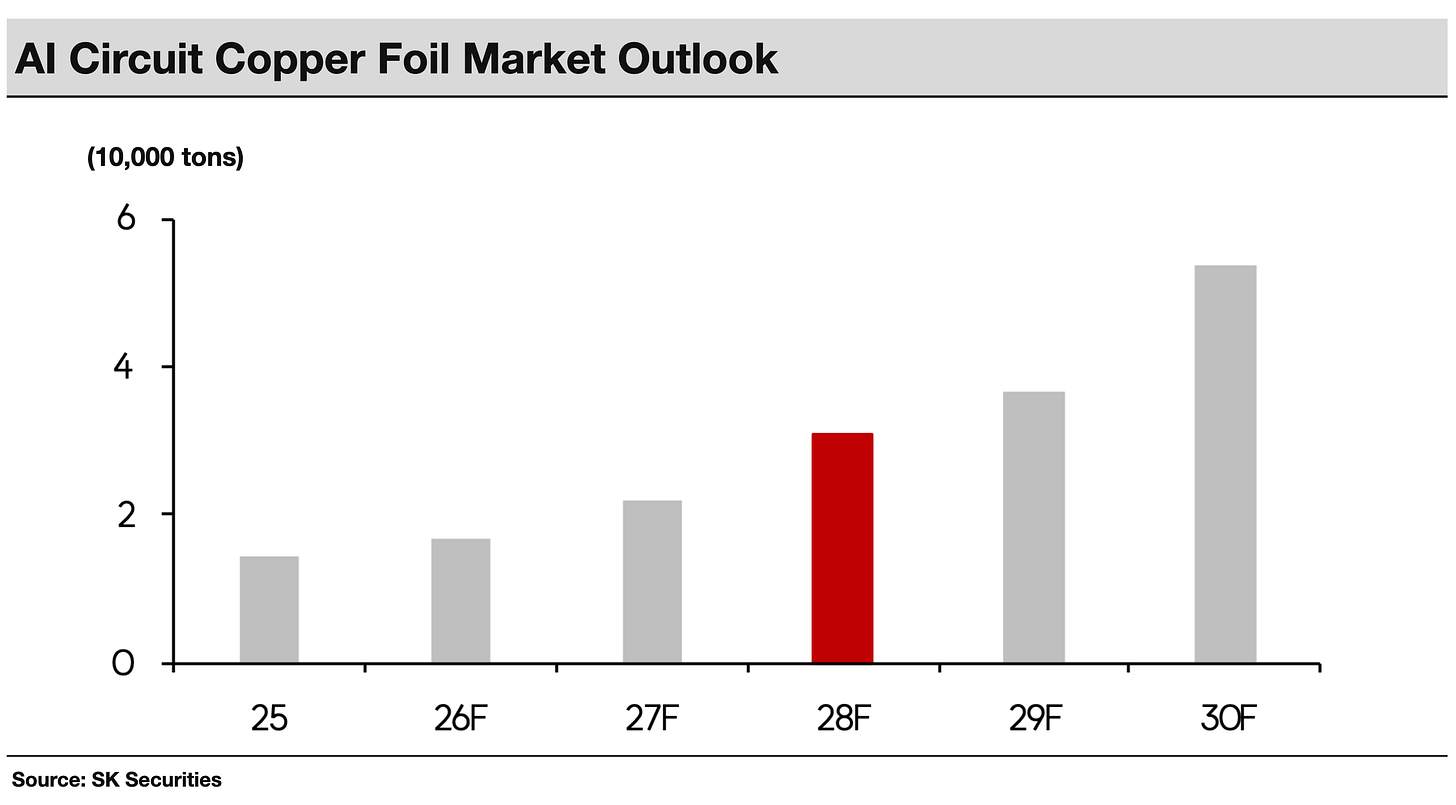

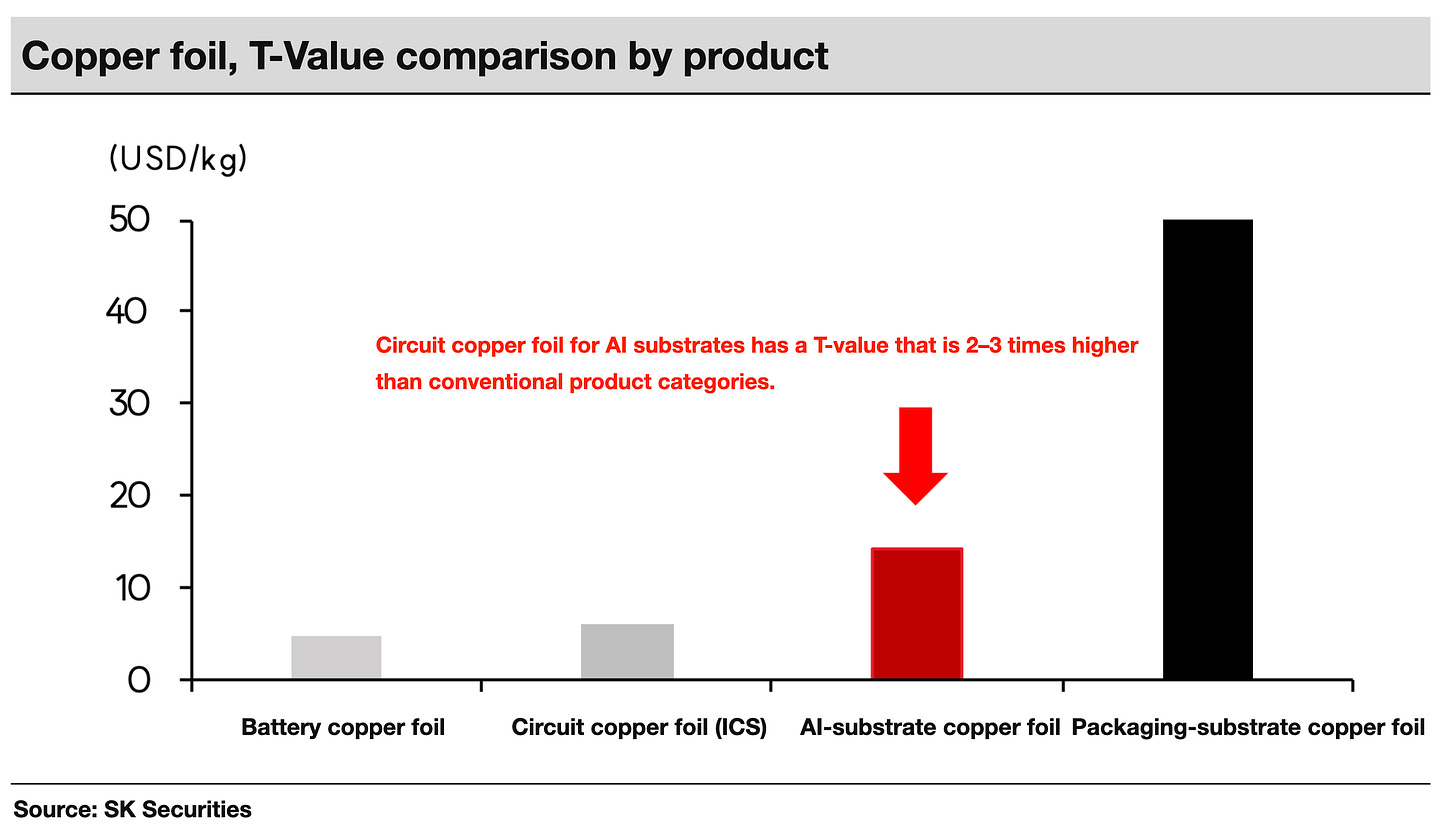

The MLB (multilayer board) circuit copper foil market is expected to grow rapidly from 15,000 tons in 2025 to 31,000 tons in 2028 and 54,000 tons in 2030. For circuit copper foil makers, orders for 2026 have already started to exceed their installed capacity. Moreover, the ASP of MLB (AI server and network equipment) circuit copper foil is more than three times higher than that of battery copper foil and general-purpose mainboard substrate copper foil, which is positive.

Furthermore, orders for circuit copper foil used in semiconductor packaging substrates are also increasing. Some substrate companies have already begun to face difficulties in securing circuit copper foil from the fourth quarter. The ASP of packaging substrate circuit copper foil is a premium market that is more than 10 times higher than that of conventional general-purpose copper foil. (Note: The above ASPs are based on T-Value excluding copper cost.)

Outlook for Circuit Foil: Reducing Dependence on Chinese and Japanese Materials

The steep improvement in circuit foil supply–demand dynamics stems from the demand within the substrate value chain to “de-China” its sourcing. Recently, Solus Advanced Materials decided to sell its European circuit foil plant to Chinese capital. This has accelerated the trend of decoupling copper foil from China. In addition, in high-end circuit foil, Japan’s Mitsui commands a market share exceeding 90%. Semiconductor and substrate manufacturers are understood to be reviewing supply chain diversification measures to gradually lower their dependence on Japan’s Mitsui.

Korean circuit foil companies are currently working with Panasonic, which leads Japanese CCL, as well as Doosan, a Korean CCL player. They have also begun sample testing with two Taiwanese CCL companies and are reportedly in discussions to supply circuit foil to all of the global top-four CCL players. Looking ahead, Korean-made circuit foil is highly likely to be supplied to the next-generation AI accelerator models of North American AI semiconductor companies. Signs of change are also emerging in packaging substrates, and Korean semiconductor substrate makers have begun to consider diversifying their circuit foil procurement channels. It is particularly encouraging that development of circuit foil for ultra-fine pattern substrates used in high-layer-count FCBGA is underway domestically.

IT Investment Strategy: Circuit Foil as a Beneficiary of the AI Shortage Theme

On top of AI momentum, it is necessary to select components/materials that are expected to face shortages. For the copper foil industry, AI substrates are a more important growth driver than ESS. Copper foil for ESS batteries is not significantly different from that for EVs; production lines can be shared. This implies that copper foil for ESS is also a market with oversupply. By contrast, circuit foil is a separate market, where a shortage is anticipated. We expect a Korean substrate value chain to form, spanning Korean-made circuit foil > Doosan Electronics > Isu Petasys. If a post-shortage price (T-Value) increase occurs, the pace of earnings improvement for the Korean copper foil industry will be even steeper. The related company here is Lotte Energy Materials.

Lotte Energy Materials’ stock has shown very strong performance over the past month.

This copper foil shortage is strikingly similar to the glass fiber shortage.

There is a dominant, absolute leader in the market (Nittobo, Mitsui).

The dominant players are conservative about capacity expansion.

Therefore, they are suffering from a severe supply shortage during this AI supercycle.

What is even more noteworthy is that the dominant players are shifting their production lines toward the highest value-added products. (In Nittobo’s case, glass fiber for AI semiconductor packages; in Mitsui’s case, copper foil for AI semiconductor packages.)

This spreads the supply shortage to non-AI semiconductor package markets, which have lower value-add than AI semiconductor packages but are still sufficiently high in value-add to attract new entrants, and enables new players that were not previously regarded as suppliers in these markets to enter. (Taiwan Glass, Lotte Energy Materials)

However, if we look at the difference between Taiwan Glass and Lotte Energy Materials, we can say that Lotte has a narrower technology gap with the leading players than Taiwan Glass does and has ample room to ramp up capacity in a short period of time.