2025 Outlook Inferred from SK Hynix’s Performance

HBM is secure

Before diving into the main discussion, let’s take a quick look at SK Hynix’s Q4 2024 performance.

SK Hynix recorded revenue of KRW 19.767 trillion and an operating profit of KRW 8.082 trillion in Q4 2024, marking a 12% and 15% increase, respectively, compared to the previous quarter.

For the full year, SK Hynix achieved revenue of KRW 66.193 trillion and an operating profit of KRW 23.4673 trillion. This represents a 102% increase in revenue compared to the previous year, with a return to profitability.

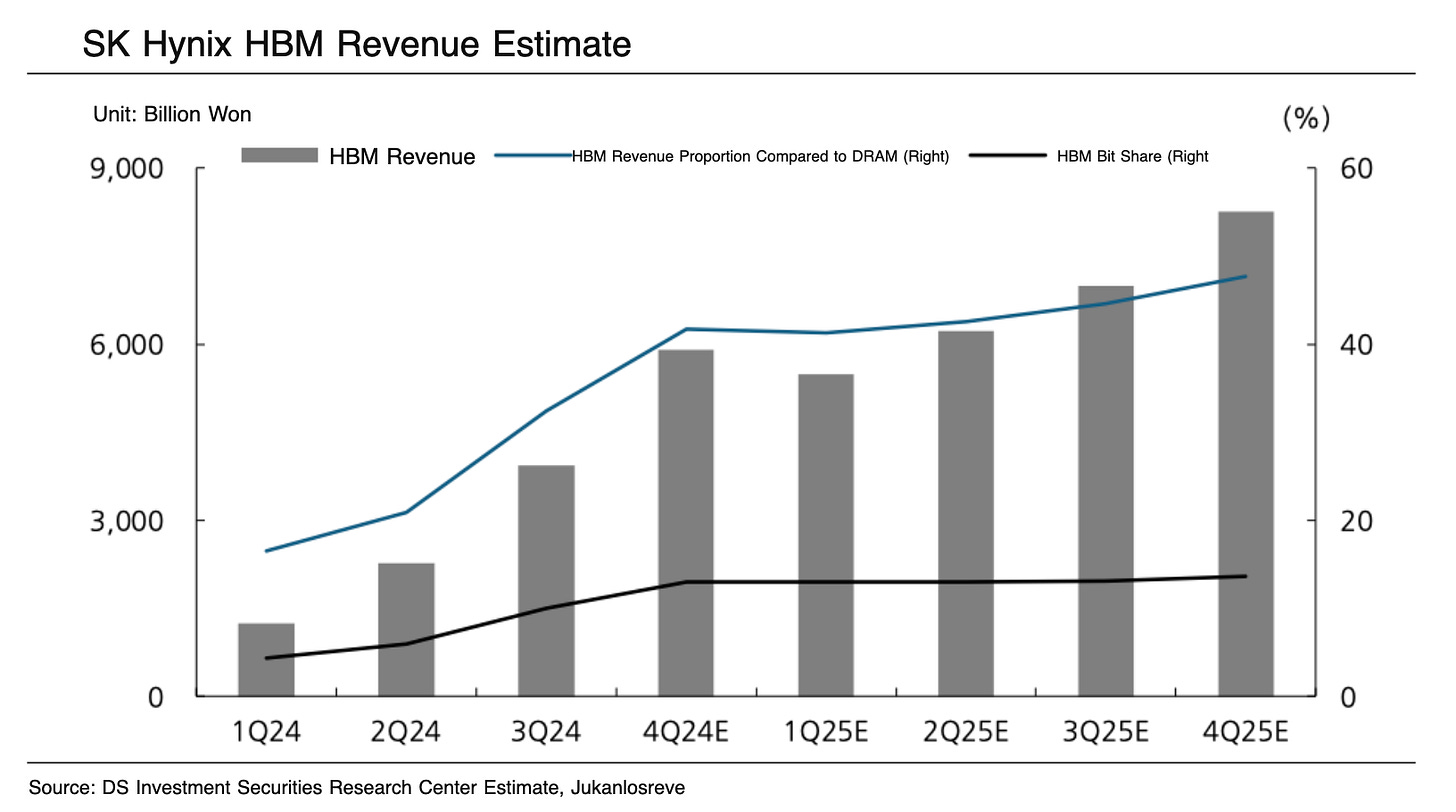

The robust demand for artificial intelligence (AI) memory semiconductors drove these record-breaking results. SK Hynix stated, “In Q4, high-bandwidth memory (HBM) accounted for over 40% of total DRAM revenue, and the company continued to expand sales of enterprise solid-state drives (eSSD).”

Upon closer examination, DRAM shipments increased by a mid-single-digit percentage compared to the previous quarter, driven by the expansion of sales for high-value-added products such as HBM3E and server-oriented DDR5 products. ASP (average selling price) rose by approximately 10% due to the product mix effect, despite price declines in legacy products like DDR4 and LPDDR4. HBM, which continued to show strong growth in Q4, began shipments of the 12-layer HBM3E product as planned and accounted for 40% of total DRAM revenue.

Additionally, it is noteworthy that DRAM demand is projected to grow by the mid-to-high teens this year, while NAND demand is expected to grow by the low teens. HBM revenue is anticipated to grow by over 100% year-on-year, driven by strong customer demand.

Now, let’s examine the macroeconomic environment.

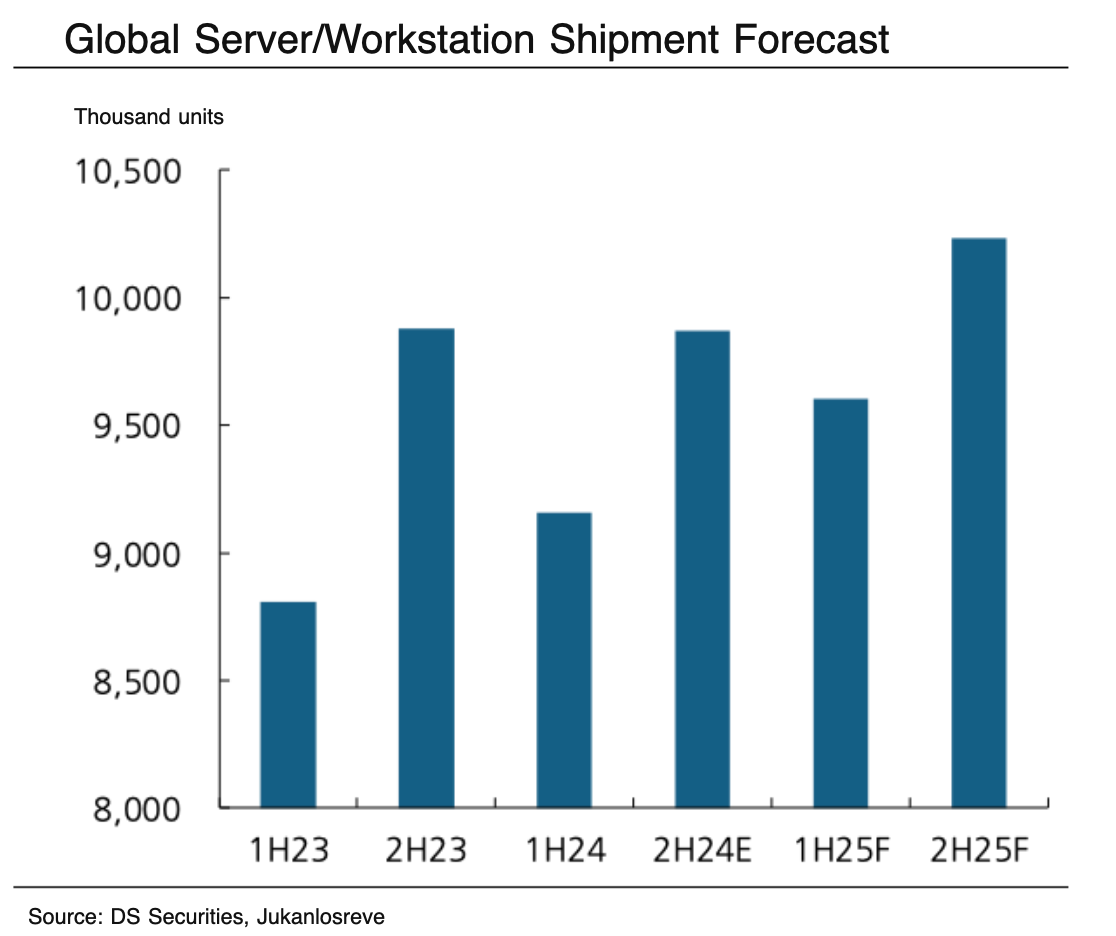

Take a look at this graph.

In the second half of 2025, investment execution by big tech companies is expected to ramp up, leading to a 7% growth in server shipments compared to the first half and a 4% increase year-over-year. NVIDIA’s new product, Blackwell, is also anticipated to begin delivery in March or April, effectively starting from Q2 2024, contributing to the growth in server shipments in the latter half of the year.

The expansion of HBM capacity in 2025 is expected to support the strong and clear demand for AI. Under Trump’s second term, the U.S.-centered AI market is anticipated to strengthen further. The competition between the U.S. and China will extend beyond tariffs, evolving into a race to dominate the AI market centered around allied nations.

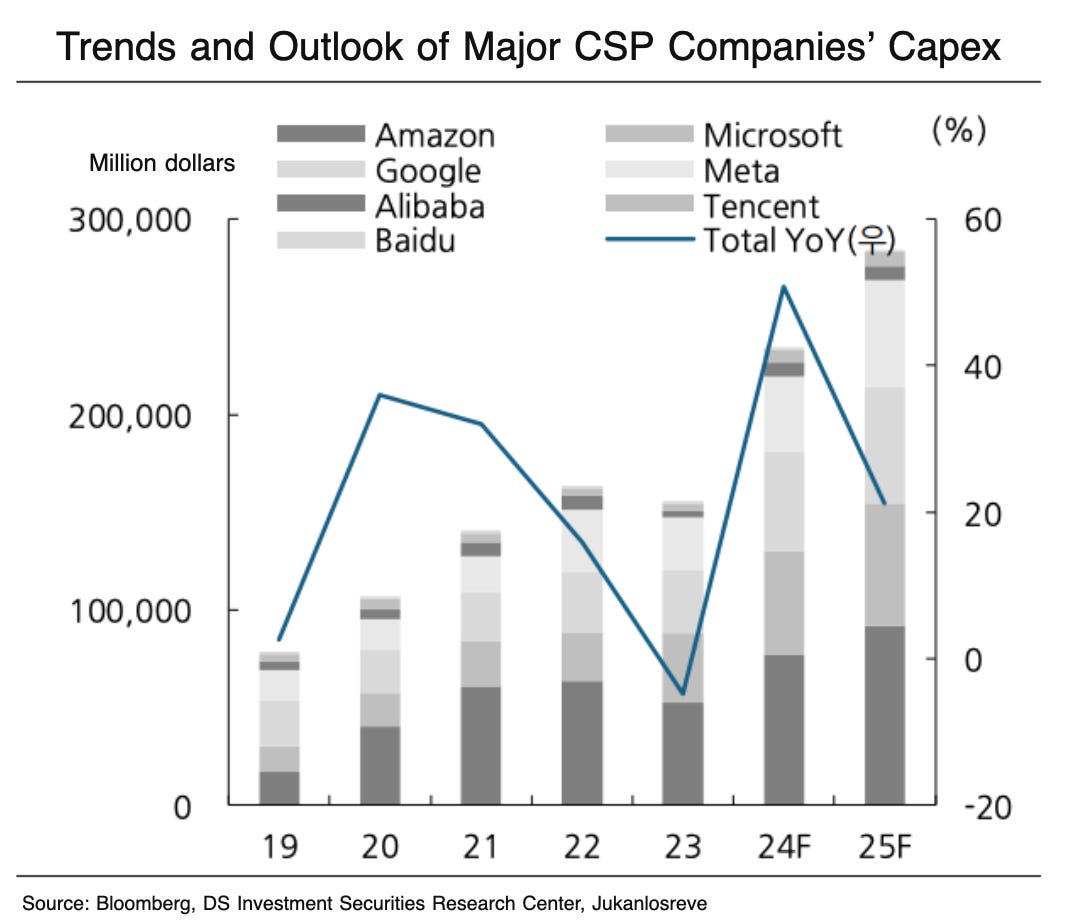

Microsoft has increased its Capex for this fiscal year (until June 2025) by 60% year-on-year to $80 billion, most of which will be used to purchase GPUs. Currently, CSPs (Cloud Service Providers) are continuing their AI investment race, which is likely to drive further Capex increases among other CSPs.

Reflecting this trend, Micron has announced new capacity expansions for HBM3e with the goal of mass production in 2026, while SK Hynix is expected to increase its capacity by around 20K wafers this year compared to previous estimates. The HBM capacity expansions by both companies are seen as evidence supporting the robust demand for HBM in 2025-2026.

Micron’s main HBM production facility is located in Taiwan, and the newly announced expansion appears to involve converting a site near its Fab7, originally allocated for NAND, for HBM3e production. This move is interpreted as an effort to secure HBM3e capacity in advance in preparation for the mass production of HBM4 in Taiwan in 2026.

SK Hynix is also maintaining a conservative capacity expansion strategy aligned with customer demand, suggesting there were clear requests from customers for this increase.